Welcome to our comprehensive guide on futures trading! In this article, we will delve into the fascinating world of futures indices, gold and silver trading, and oil trading. Whether you are an experienced trader or just starting out, we aim to provide you with valuable insights and strategies to navigate these dynamic markets. From understanding the intricacies of futures indices to unlocking the potential of trading gold and silver, as well as navigating the ever-changing landscape of oil trading, we have got you covered. So, let's dive in and explore the exciting opportunities that await in the realm of futures trading.

1. “Exploring the World of Futures Indices: A Guide for Traders”

The world of futures indices offers traders a vast array of opportunities to explore and capitalize on. With the potential for significant profits, it is essential for traders to have a comprehensive understanding of this market. In this guide, we will delve into the key aspects of futures indices, including trading gold, trading silver, and oil trading.

Futures indices serve as a benchmark for various sectors, including commodities, stocks, and currencies. These indices represent the overall performance of a specific market segment, providing traders with valuable insights into market trends and movements. By tracking futures indices, traders can make informed decisions about their investments and anticipate potential price fluctuations.

Trading gold within the futures market is a popular choice for many traders. As a safe-haven asset, gold has historically been considered a reliable investment during times of economic uncertainty. Futures contracts for gold allow traders to speculate on the price movements of this precious metal without physically owning it. By leveraging futures indices related to gold, traders can participate in this market and potentially profit from its volatility.

Similar to gold, trading silver through futures indices offers traders an avenue to capitalize on price movements without directly owning the physical asset. Silver is not only valued for its industrial applications but is also considered a precious metal. By closely monitoring the relevant futures indices, traders can identify potential trading opportunities and take advantage of price fluctuations in the silver market.

Oil trading is another prominent aspect of futures indices. Crude oil, as a crucial energy commodity, has a significant impact on global economies. Futures contracts related to oil provide traders with an avenue to speculate on its price movements. By analyzing and understanding the futures indices associated with oil, traders can make informed decisions and potentially profit from the dynamic nature of the oil market.

In conclusion, exploring the world of futures indices opens up a plethora of trading opportunities. Whether it's trading gold, trading silver, or engaging in oil trading, understanding the relevant futures indices is crucial for traders. By staying informed and monitoring these indices, traders can navigate the market with confidence and potentially achieve their desired financial goals.

2. “Unlocking the Potential: Strategies for Successful Gold and Silver Trading”

Unlocking the Potential: Strategies for Successful Gold and Silver Trading

When it comes to futures trading, gold and silver have always been popular choices for investors. These precious metals offer unique opportunities for profit and diversification in any investment portfolio. However, trading gold and silver futures requires a solid understanding of the market dynamics and the implementation of effective strategies. In this section, we will explore some key strategies that can help unlock the potential of trading gold and silver.

1. Stay Updated on Futures Indices:

Keeping a close eye on futures indices is crucial for successful gold and silver trading. Futures indices provide valuable information about market trends, price movements, and overall market sentiment. By analyzing these indices, traders can gain insights into the direction of the gold and silver markets, which can help them make informed trading decisions. Regularly monitoring futures indices, such as the COMEX Gold Futures Index or the NYMEX Silver Futures Index, can provide a competitive edge in the market.

2. Technical Analysis for Trading Gold and Silver:

Utilizing technical analysis is another essential strategy for successful gold and silver trading. Technical analysis involves studying price charts, patterns, and indicators to forecast future price movements. By identifying support and resistance levels, trend lines, and other technical patterns, traders can anticipate potential price reversals or breakouts. This approach helps traders make informed entry and exit decisions, enhancing their chances of profiting from gold and silver futures trading.

3. Fundamental Analysis for Trading Gold and Silver:

While technical analysis focuses on price patterns, fundamental analysis examines the underlying factors that impact the gold and silver markets. Factors such as geopolitical events, economic data, central bank policies, and supply and demand dynamics can significantly influence gold and silver prices. Traders should stay informed about these fundamental factors and incorporate them into their trading strategies. By analyzing both technical and fundamental aspects, traders can have a more comprehensive understanding of the gold and silver markets and make well-informed trading decisions.

4. Risk Management:

As with any trading activity, risk management is crucial for successful gold and silver trading. Traders should always define their risk tolerance and set appropriate stop-loss orders to limit potential losses. Additionally, diversifying the trading portfolio by including other assets, such as oil trading, can help spread the risk and prevent overexposure to a single market. Proper risk management ensures that traders can withstand market volatility and protect their capital in the face of adverse market conditions.

In conclusion, trading gold and silver futures can be a profitable venture when approached with the right strategies. Staying updated on futures indices, utilizing technical and fundamental analysis, and implementing effective risk management techniques are key to unlocking the potential of trading these precious metals. By following these strategies and continuously refining their trading skills, investors can navigate the gold and silver markets with confidence and increase their chances of success.

3. “Navigating the Dynamic Landscape of Oil Trading: Tips and Insights”

Navigating the Dynamic Landscape of Oil Trading: Tips and Insights

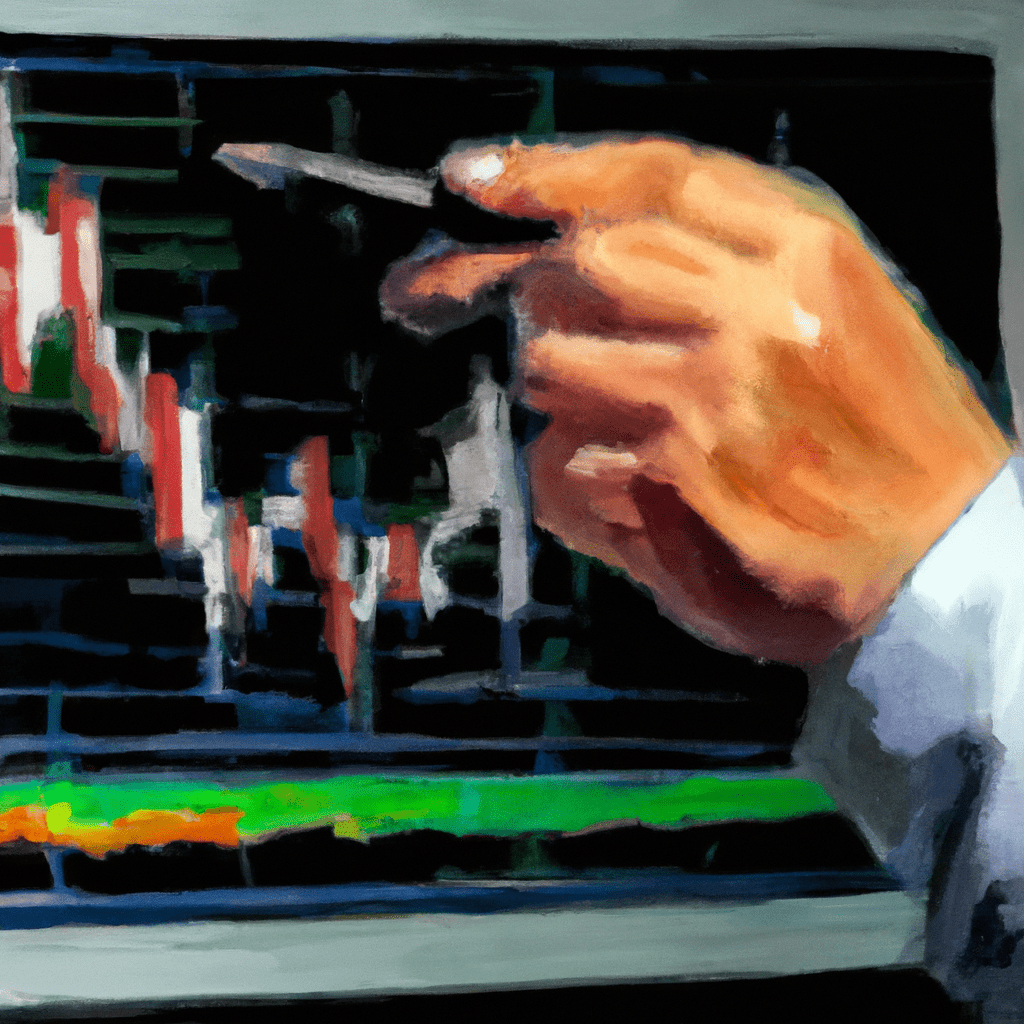

Oil trading is a complex and ever-evolving market that requires a deep understanding of various factors influencing prices and trends. Whether you are a seasoned trader or just starting, it is crucial to navigate this dynamic landscape with caution and strategic planning. In this section, we will explore some tips and insights to help you make informed decisions while trading oil futures.

1. Stay Abreast of Global Events: Global events, such as geopolitical tensions, economic policies, and natural disasters, have a significant impact on oil prices. By staying informed about these events and understanding their potential consequences on supply and demand, you can better anticipate price movements and adjust your trading strategies accordingly. Utilize news sources, industry reports, and market analysis to stay updated.

2. Technical Analysis: Employing technical analysis tools and indicators can provide valuable insights into the historical performance of oil prices and help identify patterns and trends. By studying price charts, moving averages, and support/resistance levels, you can make more informed decisions about when to enter or exit trades. Additionally, consider using oscillators and momentum indicators to gauge market sentiment and potential reversals.

3. Understand Market Fundamentals: Comprehending the fundamental factors that drive oil prices is crucial for successful trading. Factors such as supply and demand dynamics, inventory levels, OPEC decisions, and changes in global oil production can significantly impact oil futures prices. Stay updated with fundamental data, industry reports, and expert analysis to gauge the overall market sentiment and make informed trading decisions.

4. Risk Management: Oil trading carries inherent risks, and it is essential to manage your exposure effectively. Implementing risk management strategies, such as setting stop-loss orders and position sizing, can help limit potential losses and protect your capital. Diversify your portfolio by trading other futures indices like gold and silver to reduce dependence on a single market and spread out risk.

5. Utilize Technology: Embrace technology and utilize advanced trading platforms, automated systems, and algorithmic trading tools to enhance your efficiency and accuracy. These tools can provide real-time data, trade execution speed, and customizable alerts, enabling you to react swiftly to market changes and capitalize on trading opportunities.

6. Continual Learning and Adaptation: The oil trading landscape is constantly evolving, and it is crucial to continually learn and adapt your strategies. Attend industry conferences, seminars, and webinars to stay updated on the latest trends and best practices. Engage with experienced traders, join online communities, and read reputable trading books to expand your knowledge and refine your trading approach.

In conclusion, oil trading is a dynamic and challenging market, but with the right strategies and insights, traders can navigate it successfully. Stay informed, utilize technical and fundamental analysis, manage risks effectively, embrace technology, and continue learning to enhance your trading skills. By employing these tips and insights, you can increase your chances of success in the ever-changing landscape of oil trading.

In conclusion, futures trading offers a world of opportunities for traders looking to diversify their portfolios and maximize their profits. This article has provided a comprehensive guide to navigating the world of futures indices, offering valuable insights and strategies for successful gold and silver trading, as well as tips for navigating the dynamic landscape of oil trading. By understanding the intricacies of futures indices, traders can make informed decisions and capitalize on market trends. Whether it is trading gold, silver, or oil, having a solid understanding of the market dynamics and employing effective trading strategies is crucial for success. With the right knowledge and tools, traders can unlock the potential of futures trading and achieve their financial goals. So, dive into the world of futures indices, embrace the opportunities in trading gold, silver, and oil, and take your trading journey to new heights.