Are you looking to trade uranium in Adelaide, South Australia. Look no further. With its growing demand and economic potential, uranium trading in Adelaide is becoming increasingly popular. Whether you are looking to buy or sell, the Adelaide market offers a promising opportunity for investors and traders.

In Adelaide, uranium trading is a booming industry, with numerous companies and individuals engaging in buying and selling commodities. This presents a great opportunity for investors to diversify their portfolios and capitalize on the rising demand for uranium. With Adelaide being a central hub for the mining industry, the city offers efficient and reliable trading platforms, making it a prime location for uranium trading. Interested in delving into the world of uranium trading in Adelaide but not sure where to start.

Look no further. This article will provide you with valuable insights and expert tips from renowned subject matter experts in this field. From understanding the market trends to navigating the trading process, this article will give you all the information you need to make informed decisions and succeed in the Adelaide uranium trading market. Get ready to enter the exciting and lucrative world of uranium trading in Adelaide, South Australia.

With its growing demand and economic potential, this market presents a promising opportunity for traders and investors. As the demand for clean energy sources continues to rise, the demand for uranium is expected to increase, making Adelaide an ideal location for trading this highly sought-after commodity. So why wait. Take a look at the strategies, trends, and tips shared by experts and start your journey in uranium trading today.

What is uranium trading?

Uranium trading is the buying and selling of uranium as a commodity. As an essential element in nuclear power production, uranium has become a valuable resource in today's energy market. Like other commodities such as gold and oil, the price of uranium is determined by supply and demand dynamics, making it a highly sought-after investment.

Discover the basics of uranium trading

Uranium trading involves the purchase and sale of uranium either physically or through financial instruments. It differs from other commodities trading in that the majority of uranium is bought and sold through long-term contracts between suppliers and nuclear power companies. This is due to the unique nature of the product and its reliance on the nuclear energy industry.

One of the significant factors that determine the price of uranium is global demand for nuclear power. As more countries turn to nuclear energy as a clean and efficient energy source, the demand for uranium is expected to rise. In contrast, a decrease in demand from countries phasing out nuclear power can lead to a decrease in uranium prices. This makes uranium trading a lucrative opportunity for investors looking to capitalize on the growth potential of the nuclear industry.

The current state of uranium trading in adelaide

The city of adelaide, located in south australia, is a key hub for uranium trading. With over 80% of australia's known uranium reserves located in the state, adelaide has become a center for the uranium market in the country. The australian securities exchange (asx) is also located in adelaide, providing a platform for investors to trade uranium stocks and futures.

Adelaide's strategic location and infrastructure make it an ideal location for international companies to participate in the uranium market. The city's proximity to major uranium mining sites, such as olympic dam and beverley, ensures a steady supply of uranium for trading activities. Furthermore, adelaide's advanced transportation and storage facilities make it a convenient location for the import and export of uranium globally.

The potential for growth in adelaide’s uranium trading market

The future of uranium trading in adelaide looks promising, with several developments on the horizon. The australian government has recently lifted its ban on the construction of new nuclear power plants, creating potential for increased demand for uranium in the country. This move has also sparked interest from international companies looking to invest in australia's nuclear energy sector.

Moreover, the south australian government has implemented policies to encourage the growth of the uranium industry in the state. These include streamlining regulatory processes and implementing tax incentives for companies operating in the uranium market. These developments are expected to attract more investment and drive the growth of uranium trading in adelaide.

The key players in adelaide’s uranium trading market

There are several key players in adelaide's uranium trading market, including mining companies, traders, and financial institutions. Bhp group, the world's largest mining company, has a significant presence in adelaide's uranium industry through its ownership of olympic dam, one of australia's largest uranium mines. Other major mining companies in the state include heathgate resources and paladin energy.

In addition to mining companies, there are also financial institutions and traders involved in uranium trading in adelaide. These include energy resources australia (era), a subsidiary of rio tinto, and the asx-listed uraniumsa ltd. These companies provide investors with opportunities to invest in uranium-related activities and take part in the trading of uranium commodities.

in conclusionUranium trading is a dynamic market that offers investors the potential for high returns. As a crucial element in nuclear energy production, uranium plays a vital role in powering our world. Adelaide's strategic location, advanced infrastructure, and government support make it an ideal location for participating in uranium trading. With the potential for growth in australia's nuclear energy sector, investing in adelaide's uranium market could yield significant benefits for traders and companies alike.

Disclaimer: this is not investment advice. Investing in uranium carries significant risks and should be approached with caution. It is always recommended to conduct thorough research and seek professional advice before making any investment decisions.

Buying and selling uranium in adelaide

Located in the heart of south australia, the city of adelaide is known for its bustling commodities market. Among the various commodities traded in the city, uranium stands out as a highly sought-after resource. With the growing demand for alternative sources of energy, it is no surprise that uranium has become a popular trading commodity. If you are interested in buying and selling this valuable resource in adelaide, this article will guide you through the process and provide tips for successful uranium trading.

The basics of uranium trading

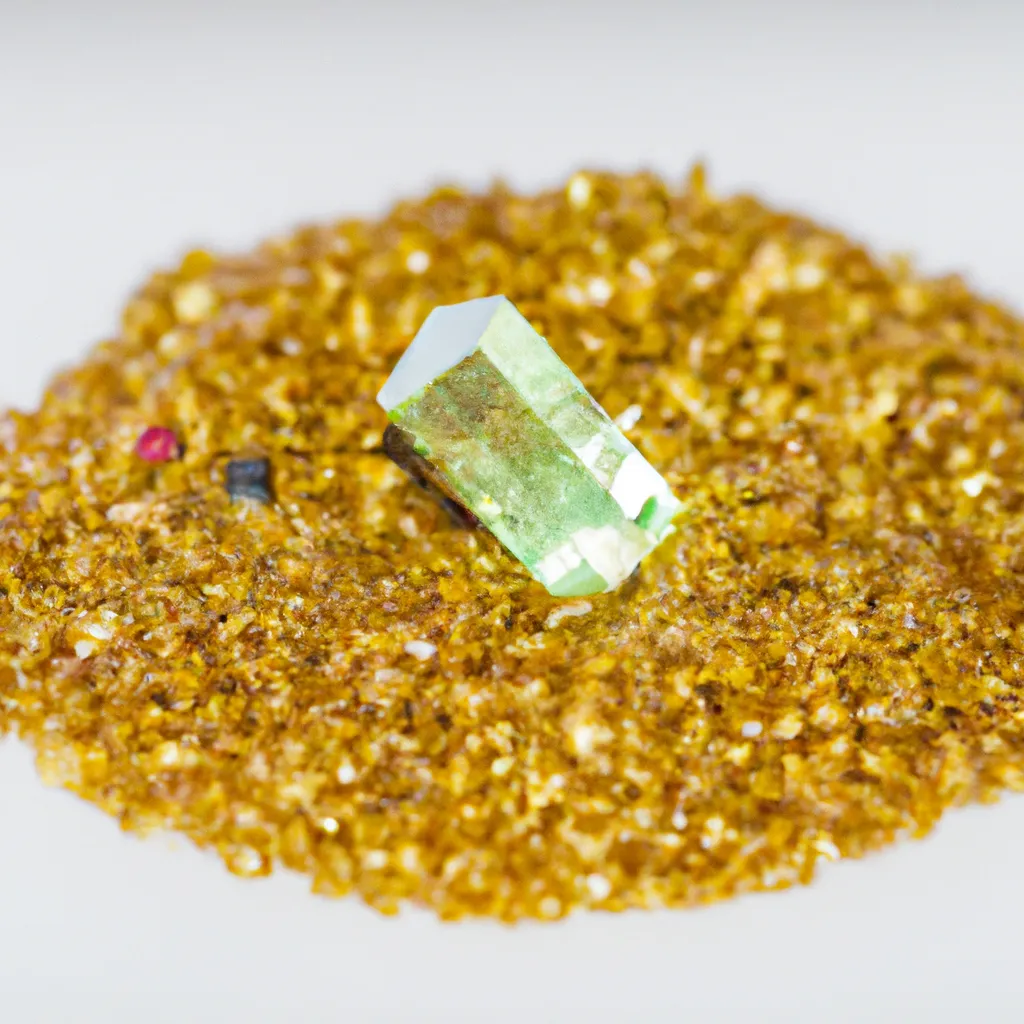

Uranium is a radioactive heavy metal that is primarily used as fuel in nuclear reactors. It has a variety of commercial uses such as generating electricity, producing medical isotopes, and powering space missions. In the commodities market, uranium is primarily traded in its natural state as uranium oxide.

The most common way to invest in uranium is through stocks of companies involved in the production, exploration, and trading of uranium. These companies are often listed on the australian securities exchange (asx) and provide an opportunity for investors to gain exposure to the uranium market.

The regulations and requirements for uranium trading in south australia

South australia is the only state in australia that allows the mining and exportation of uranium. As such, there are strict regulations and requirements in place for uranium trading in adelaide. The sale and transportation of uranium in the state are regulated by the radiation protection and control act 1982, the radiation protection and control (transport of radioactive substances) regulations 2003, and the commonwealth environment protection and biodiversity conservation act 1999.

If you are planning to buy and sell uranium in adelaide, it is essential to adhere to these regulations and obtain the necessary permits and licenses. This includes obtaining a license from the radiation protection branch and following the guidelines for the safe transport of radioactive substances. Failure to comply with these regulations can result in severe penalties, so it is crucial to stay informed and follow the rules.

Strategies for successful uranium trading in adelaide

Like any other investment, trading uranium in adelaide requires careful consideration and well-informed strategies. Here are some tips to help you navigate the uranium market and increase your chances of success:

1. Stay informedKeep up-to-date with the latest news and developments in the uranium market. Subscribe to industry newsletters and publications and follow reputable sources on social media. This will help you understand market trends, supply and demand, and other factors that can affect the price of uranium.

2. Diversify your portfolioUranium prices can be volatile, so it is crucial to diversify your portfolio when investing in this commodity. Consider investing in multiple companies involved in uranium production, as well as other commodities such as gold, which can act as a hedge during times of market instability.

3. Understand risk versus rewardAs with any investment, there are risks involved in trading uranium. It is essential to understand these risks and weigh them against the potential rewards. Do your research and consult with experts before making any investment decisions.

4. Network and connectThe commodities market in adelaide is heavily influenced by relationships and connections. Attend industry conferences and events to network with other investors, brokers, and industry professionals. This can provide valuable insights and opportunities for potential trades.

5. Seek professional guidanceIf you are new to the uranium market, seeking professional guidance can be helpful in understanding the complexities of trading this commodity. Consider consulting with a financial advisor or a broker with experience in uranium trading.

The future of uranium trading in adelaide

The demand for clean and sustainable energy sources is expected to drive an increase in the use of nuclear power globally. This presents a promising outlook for the uranium market, making it an attractive investment opportunity in adelaide. However, it is essential to note that the market is subject to various economic, political, and environmental factors that can affect its performance.

As the industry continues to evolve, it is crucial to stay informed and adapt your strategies accordingly. With proper knowledge and careful planning, buying and selling uranium in adelaide can be a profitable venture.

Uranium trading in adelaide is a complex yet lucrative endeavor. Understanding the basics of trading, adhering to regulations, and implementing well-informed strategies can increase your chances of success. As with any investment, it is important to thoroughly research and stay informed about the market to make sound decisions. With the growing demand for clean energy sources, the future of uranium trading in adelaide looks promising, making it an attractive option for savvy investors.

Comparing uranium with other commodities

When it comes to trading in the market, there are a multitude of commodities that investors can choose from. From precious metals like gold to industrial materials like iron ore, each commodity has its unique features and characteristics that make it a popular choice for trading. One commodity that often stands out among the rest is uranium. Despite its relative obscurity compared to other commodities, uranium is a valuable asset that should not be overlooked. In this section, we will dive into the unique features of uranium that make it a valuable commodity in the trading market, compare it with other popular commodities, and learn how to diversify your portfolio by including uranium in your trading activities.

The unique features of uranium

Uranium, known for its radioactive properties, is primarily used as fuel in nuclear power plants. It is a highly sought-after commodity, as it plays a vital role in the production of clean and efficient energy. In fact, approximately 20% of the world's electricity comes from nuclear power plants, with uranium being the main source of fuel.

One of the unique features of uranium is that it is a non-renewable resource, meaning it cannot be replaced or replenished. Once the existing uranium reserves are depleted, there will be no more left to use. This makes the commodity even more valuable as its scarcity drives up demand and prices. Furthermore, most of the world's uranium reserves are located in politically stable countries like australia, canada, and kazakhstan, reducing the risk of supply disruptions due to geopolitical factors.

Another crucial feature of uranium is its limited production. Unlike other commodities that can be mined and produced on a large scale, uranium production is tightly controlled due to its potential for nuclear weapons proliferation. This limited production also adds to the overall value of uranium in the trading market.

Comparing uranium with other popular commodities

One of the most commonly traded commodities in the market is gold. Known for its financial value and cultural significance, gold has been part of human history for centuries. Unlike uranium, gold is considered a safe-haven asset, meaning it is a go-to investment in times of economic uncertainty. This makes gold's price less volatile compared to uranium, but at the same time, it may not offer high returns in the long run.

Iron ore, on the other hand, is an industrial material used in the production of steel. It is a primary component in the construction and manufacturing industries, making it a significant global commodity. While iron ore's price is also impacted by supply and demand, it is not as volatile as uranium due to its higher availability and production.

When compared to gold and iron ore, uranium's price tends to experience more significant fluctuations. However, this also means that there is potential for higher returns in the long run, especially as the demand for clean energy continues to rise. Uranium has also proven to be a resilient commodity, with its price rebounding from previous market downturns, making it a valuable asset for diversifying a trading portfolio.

Diversifying your portfolio

As with any investment, diversification is key to managing risks and achieving long-term success. Including uranium in your trading activities can be a valuable addition to your portfolio, as it offers a unique set of features and potential for higher returns. Investing in uranium can provide a hedge against inflation and economic uncertainty and offer diversification from traditional assets like stocks and bonds.

It is crucial to note that trading in uranium requires a thorough understanding of the market, geopolitics, and technical aspects of the commodity. This is where consulting with a financial advisor or broker with experience in trading commodities like uranium can be beneficial. They can help you navigate the market and make informed decisions based on your risk tolerance and investment goals.

Uranium is a unique commodity that offers significant potential for trading success. Its limited production, increasing demand, and valuable role in clean energy make it a valuable asset to include in a diversified and balanced trading portfolio. With careful research, strategic planning, and expert guidance, trading in uranium can be a profitable venture for investors. So, consider adding this valuable commodity to your trading activities and watch your portfolio thrive.

Factors affecting uranium trading in adelaide

Uranium, a highly sought-after mineral, plays a significant role in the energy market of adelaide, south australia. The capital city is known for its strong economy and robust mining industry, making it an ideal location for uranium trading. However, like any other commodity, uranium trading in adelaide is also subject to various factors that can influence its market value. These factors range from economic and political to environmental and regulatory, making it crucial for traders and investors to stay informed and adapt accordingly.

The role of the australian securities exchange (asx)

The australian securities exchange (asx) is the largest exchange in australia, and it plays a vital role in the trading of uranium and other commodities in adelaide. The asx provides a platform for companies to list and trade their shares, including uranium mining and exploration companies. It also offers investors various options to trade uranium, such as futures contracts, options, and exchange-traded commodities.

The asx operates within a well-regulated environment, providing security for traders and investors. Its strict listing and disclosure requirements ensure that companies listed on the exchange adhere to sound business practices and provide transparent information to the market. This level of regulation helps maintain confidence in the market and attracts more participants, ultimately benefiting the uranium trading industry in adelaide.

The impact of economic and political factors on uranium trading

Economic and political conditions can significantly affect the demand and supply for uranium, thus impacting its trading in adelaide. As a global commodity, uranium's price is influenced by global economic trends and political events. For instance, a decrease in demand for nuclear power due to a stagnant economy or geopolitical tensions can cause a decline in uranium prices, affecting trading in adelaide.

On the other hand, positive economic conditions and political stability can lead to an increase in demand and the price of uranium. For example, the rise of emerging economies, such as china and india, has led to an increase in demand for uranium, primarily for their nuclear energy programs. This demand has had a positive impact on uranium trading in adelaide, with prices reaching record highs in recent years.

The fungibility factor in uranium trading

Fungibility refers to the ability to exchange one product for another of equal value, and it is a crucial factor in the trading of commodities, including uranium. The fungibility of uranium is affected by its unique physical and chemical properties, making it challenging to substitute with other minerals. This lack of interchangeability can limit the trading options for uranium, as it can only be traded in its raw or slightly processed state.

Additionally, the fungibility of uranium is influenced by regulatory requirements and international policies regarding the use and trade of nuclear materials. These regulations can impact the transport and trading of uranium, affecting its market value. As such, traders and investors need to stay abreast of any changes in regulations and policies that could impact the fungibility of uranium in adelaide.

Overall, several factors can influence uranium trading in adelaide, including the role of the asx, economic and political conditions, and the fungibility factor. As with any investment, it is essential to research and stay informed about these factors to make informed decisions and navigate the market successfully. With its strong economy and regulatory framework, adelaide remains a favorable location for uranium trading, and staying updated on market trends and factors can help traders and investors capitalize on this valuable commodity.