Welcome to our comprehensive guide on financial derivatives, specifically focusing on futures contracts and options trading. Whether you are a beginner looking to understand the basics or an experienced trader aiming to master futures options trading, this article has you covered. We will explore the world of stock derivatives and provide you with valuable insights and strategies for success. Join us as we delve into the exciting realm of financial derivatives and equip you with the knowledge and tools needed to navigate the complex landscape of futures and options. So, let's get started with our beginner's guide to understanding financial derivatives and explore the fascinating world of futures contracts and options trading.

1. “Understanding Financial Derivatives: A Beginner’s Guide to Futures Contracts and Options Trading”

Financial derivatives are complex financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. They are commonly used by investors and traders to manage risk, speculate on price movements, and enhance returns. In this beginner's guide, we will focus on two types of financial derivatives: futures contracts and options trading.

Futures contracts are agreements between two parties to buy or sell an asset at a predetermined price and date in the future. These contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME). Futures contracts enable investors to speculate on the future price of an asset or hedge against potential price fluctuations.

For example, let's say an investor expects the price of crude oil to increase in the next three months. Instead of directly buying barrels of oil, the investor can enter into a futures contract to buy oil at a predetermined price in the future. If the price of oil indeed rises, the investor can profit from the price difference. On the other hand, if the price decreases, the investor may incur losses.

Options trading, on the other hand, provides investors with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period. Unlike futures contracts, options trading gives investors more flexibility as they can choose whether to exercise the option or let it expire.

There are two types of options: call options and put options. A call option gives the holder the right to buy an asset, while a put option gives the holder the right to sell an asset. Investors can use options to speculate on price movements, hedge existing positions, or generate income through options writing.

For instance, if an investor believes that a particular stock will experience a significant price increase, they can purchase a call option. If the stock price rises above the predetermined price (strike price) before the option expires, the investor can exercise the option and profit from the price difference. However, if the stock price remains below the strike price, the investor may choose not to exercise the option and limit their loss to the premium paid for the option.

In summary, financial derivatives, such as futures contracts and options trading, provide investors with opportunities to manage risk, enhance returns, and speculate on price movements. While they can be complex instruments, understanding the basics of futures and options can empower beginners to navigate the world of stock derivatives and futures options trading.

2. "Exploring the World of Stock Derivatives: An Introduction to Financial Derivatives and Futures & Options"

Financial derivatives are an essential part of the global financial market, enabling investors to manage risk and speculate on the future movements of various underlying assets. Among the various types of derivatives, stock derivatives hold particular significance for investors seeking exposure to the equity markets.

Stock derivatives, also known as equity derivatives, are financial contracts whose value is derived from the price of an underlying stock. They provide investors with an opportunity to participate in the performance of a particular stock without owning the actual shares. This makes stock derivatives an attractive option for those who wish to gain exposure to the stock market without committing a significant amount of capital.

One of the most common types of stock derivatives is the futures contract. A futures contract is an agreement between two parties to buy or sell a specified quantity of an underlying asset, in this case, a particular stock, at a predetermined price and date in the future. Futures contracts are standardized agreements traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Stock Exchange (NYSE).

Options are another popular type of stock derivative. Options provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) a specified quantity of a stock at a predetermined price (strike price) within a specific period. Options can be traded on exchanges, just like futures contracts, or over-the-counter (OTC) between two parties.

For beginners looking to venture into the world of financial derivatives, it is crucial to understand the basics of futures and options trading. Futures & options can offer opportunities for profit, but they also carry inherent risks. Therefore, it is essential to educate oneself thoroughly before engaging in such trading activities.

A beginner's guide to futures & options trading should cover topics such as understanding the mechanics of futures contracts and options, the factors that influence their prices, and the potential risks involved. Additionally, it should provide insights into how to analyze market trends, develop trading strategies, and manage risk effectively.

By gaining a solid understanding of financial derivatives, beginners can unlock the potential to diversify their investment portfolios, hedge against market volatility, and potentially generate significant returns. However, it is crucial to approach futures & options trading with caution, as it requires careful analysis, risk management, and ongoing monitoring of market conditions.

In conclusion, stock derivatives, including futures and options, play a vital role in the world of financial derivatives. They offer investors various opportunities to participate in the equity markets without owning the actual stocks. Beginners interested in exploring futures & options trading should equip themselves with knowledge, consult experts, and approach this complex field with a cautious and informed mindset.

3. “Mastering Futures Options Trading: Strategies and Tips for Success with Financial Derivatives”

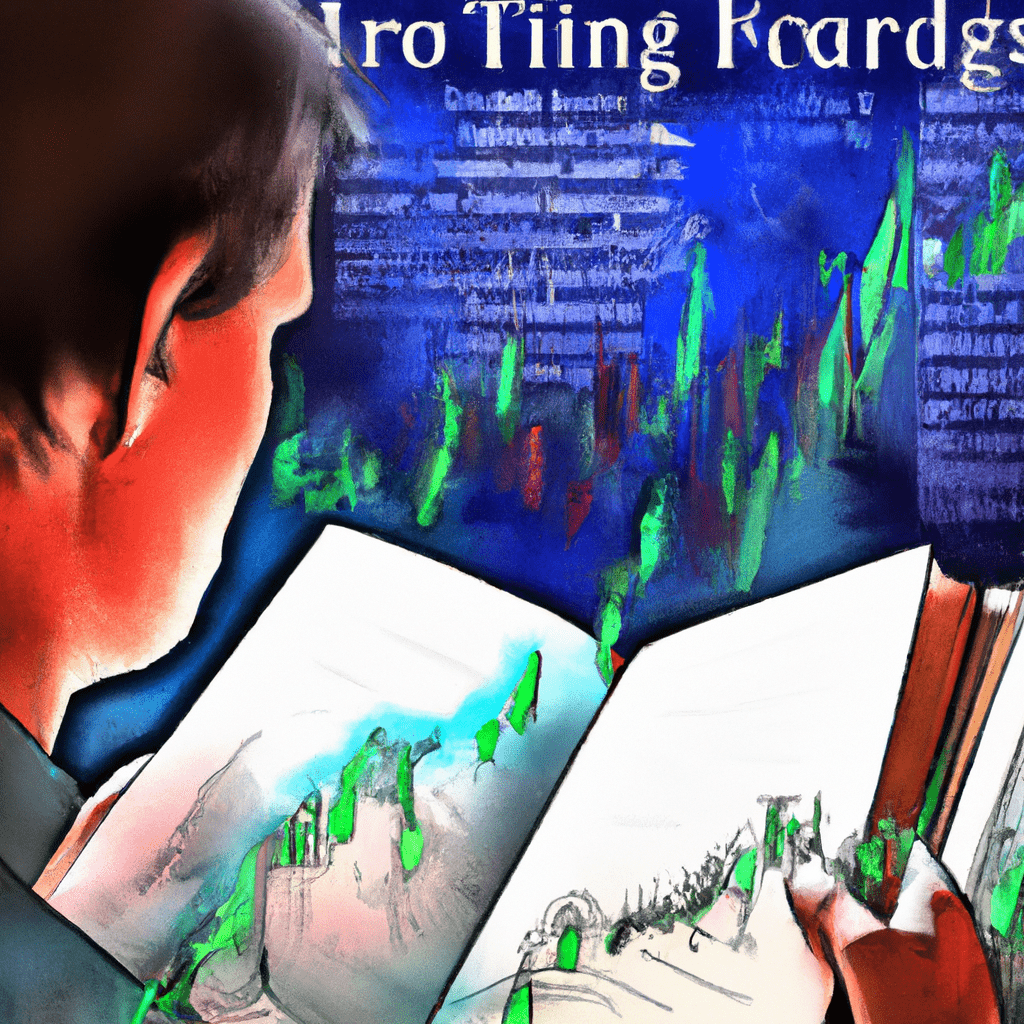

When it comes to delving into the world of financial derivatives, futures options trading is a significant aspect that deserves attention. One valuable resource for beginners seeking to master this trading strategy is the book titled "Mastering Futures Options Trading: Strategies and Tips for Success with Financial Derivatives."

This comprehensive guide serves as an excellent starting point for individuals who are new to futures and options trading. The book covers various essential topics, providing readers with a solid foundation in understanding the intricacies of financial derivatives. It offers a step-by-step approach to learning and implementing successful trading strategies.

The primary focus of "Mastering Futures Options Trading" is on futures contracts, which are one of the most popular types of financial derivatives. These contracts allow traders to buy or sell an underlying asset, such as commodities, currencies, or stock indices, at a predetermined price and date in the future. By utilizing futures contracts, investors can speculate on the price movements of these underlying assets without actually owning them.

The book emphasizes the importance of having a well-defined trading plan and risk management strategy. It provides insights into different trading techniques and approaches that can be employed to maximize profits and minimize potential losses. From understanding the basics of futures and options to advanced strategies, the guide offers valuable insights and practical tips for success in futures options trading.

For beginners, the book serves as a comprehensive beginner's guide, providing a clear explanation of complex concepts and terminology related to financial derivatives. It helps readers understand the key differences between futures and options, enabling them to make informed decisions while navigating the market.

Furthermore, "Mastering Futures Options Trading" explores the relationship between stock derivatives and futures options. It highlights how these financial instruments can be used in conjunction with one another to create various trading strategies. By understanding this relationship, traders can leverage the potential benefits of both stock derivatives and futures options, enhancing their chances of success in the market.

In conclusion, "Mastering Futures Options Trading: Strategies and Tips for Success with Financial Derivatives" is an invaluable resource for beginners looking to delve into the world of financial derivatives. By providing a comprehensive beginner's guide and offering insights into successful trading strategies, this book equips readers with the necessary knowledge and tools to navigate the complexities of futures options trading. Whether you are a novice or an experienced trader, this guide serves as an essential reference for achieving success in the dynamic world of financial derivatives.

In conclusion, financial derivatives, such as futures contracts and options trading, offer individuals and investors a wide range of opportunities in the world of stock derivatives. This article has provided a comprehensive beginner's guide to understanding these complex financial instruments, exploring their various uses and strategies for success. By mastering futures options trading, investors can potentially maximize their profits and manage risks effectively. Whether you are a beginner or an experienced trader, it is crucial to continually educate yourself on the intricacies of financial derivatives to make informed decisions. With the knowledge gained from this article, individuals can confidently navigate the world of financial derivatives and make the most of their investment opportunities.