Financial derivatives play a crucial role in the world of finance, offering investors and traders unique opportunities to manage risk and speculate on the future movements of various assets. For those new to the concept, understanding financial derivatives can seem intimidating and complex. However, with the right guidance and knowledge, anyone can grasp the basics of futures contracts and options trading. In this article, we will provide a beginner's guide to futures contracts and options trading, exploring the world of stock derivatives and delving into the intricacies of futures and options trading. Whether you are a novice investor or an experienced trader looking to expand your knowledge, this comprehensive guide to financial derivatives will equip you with the essential tools needed to navigate the exciting world of futures and options trading. So, let's embark on this journey to demystify financial derivatives and unlock the potential they hold for your investment portfolio.

1. “Understanding Financial Derivatives: A Beginner’s Guide to Futures Contracts and Options Trading”

Financial derivatives are complex financial instruments that derive their value from an underlying asset. They serve as a way for investors and traders to manage risks and speculate on price movements in various markets. Two common types of financial derivatives are futures contracts and options.

Futures contracts are agreements between two parties to buy or sell an asset at a predetermined price on a specified future date. These contracts enable market participants to hedge against price fluctuations and lock in future prices. For example, a farmer might enter into a futures contract to sell their crops at a certain price, protecting themselves from potential price declines.

Options, on the other hand, provide the holder with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified time period. There are two types of options: call options and put options. Call options give the holder the right to buy an asset, while put options give the holder the right to sell an asset. Options provide flexibility and can be used for risk management or speculative purposes.

For beginners, understanding financial derivatives can be challenging. It is crucial to grasp the basic concepts and terminology associated with futures contracts and options trading. A beginner's guide to futures contracts and options trading can help individuals navigate through the complexities of these instruments.

To start, beginners should familiarize themselves with the fundamentals of futures and options. This includes understanding the underlying assets, contract specifications, and the mechanics of trading. It is essential to know the difference between long and short positions, as well as the concept of leverage in futures trading.

Furthermore, beginners should learn how to analyze market trends and use technical and fundamental analysis to make informed trading decisions. They should also understand the various strategies employed in futures and options trading, such as hedging, speculation, and arbitrage. Risk management techniques, including setting stop-loss orders and managing position sizes, are also critical for beginners to minimize potential losses.

As beginners delve into futures and options trading, it is essential to gain practical experience through simulated trading or paper trading. This allows individuals to practice their strategies without risking real money. Additionally, seeking guidance from experienced traders or enrolling in educational programs can provide valuable insights and accelerate the learning process.

In conclusion, financial derivatives, particularly futures contracts and options, offer opportunities for investors and traders to manage risks and speculate on price movements. However, beginners should approach these instruments with caution and seek to understand the underlying concepts and strategies involved. By following a beginner's guide to futures contracts and options trading, individuals can develop the necessary skills and knowledge to navigate the world of stock derivatives and futures options trading effectively.

2. “Exploring the World of Stock Derivatives: An Overview of Financial Futures and Options”

Financial derivatives are powerful financial instruments that allow investors to manage risk and speculate on the future price movements of various underlying assets. Among the different types of financial derivatives, stock derivatives, specifically financial futures and options, play a significant role in the world of finance.

Financial futures contracts are agreements between two parties to buy or sell an underlying asset, such as stocks, at a predetermined price on a specified future date. These contracts are standardized and traded on organized exchanges. The futures contract acts as a binding agreement, obligating both parties to fulfill their obligations at the agreed-upon terms. By trading futures contracts, investors can take advantage of price fluctuations in the underlying asset without owning it physically.

Options, on the other hand, provide investors with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as stocks, at a predetermined price (strike price) within a specified period. Options can be traded on exchanges, similar to futures contracts. They offer flexibility, enabling investors to speculate on the direction of price movements or hedge their existing positions.

Both financial futures and options serve various purposes for investors. Speculators use these instruments to make bets on the future direction of stock prices, aiming to generate profits from price movements. Additionally, investors can use derivatives to hedge their portfolios against adverse price changes. For example, if an investor holds a significant amount of stocks and anticipates a market downturn, they can purchase put options to protect themselves from potential losses.

For beginners looking to explore futures and options trading, it is essential to understand the basics and seek guidance from experienced professionals or educational resources. A beginners guide to futures and options can provide valuable insights on how these instruments work, the associated risks, and the strategies used by market participants. By gaining a comprehensive understanding, beginners can make informed decisions and mitigate potential risks.

In conclusion, stock derivatives, including financial futures and options, offer investors a wide range of opportunities to manage risk and profit from price movements. By trading these instruments, individuals can participate in the financial markets and potentially achieve their investment goals. However, it is crucial to approach derivatives trading with caution and gain a solid understanding of the fundamentals before diving into the complexities of futures and options.

3. “Mastering the Basics of Futures and Options Trading: A Comprehensive Guide to Financial Derivatives”

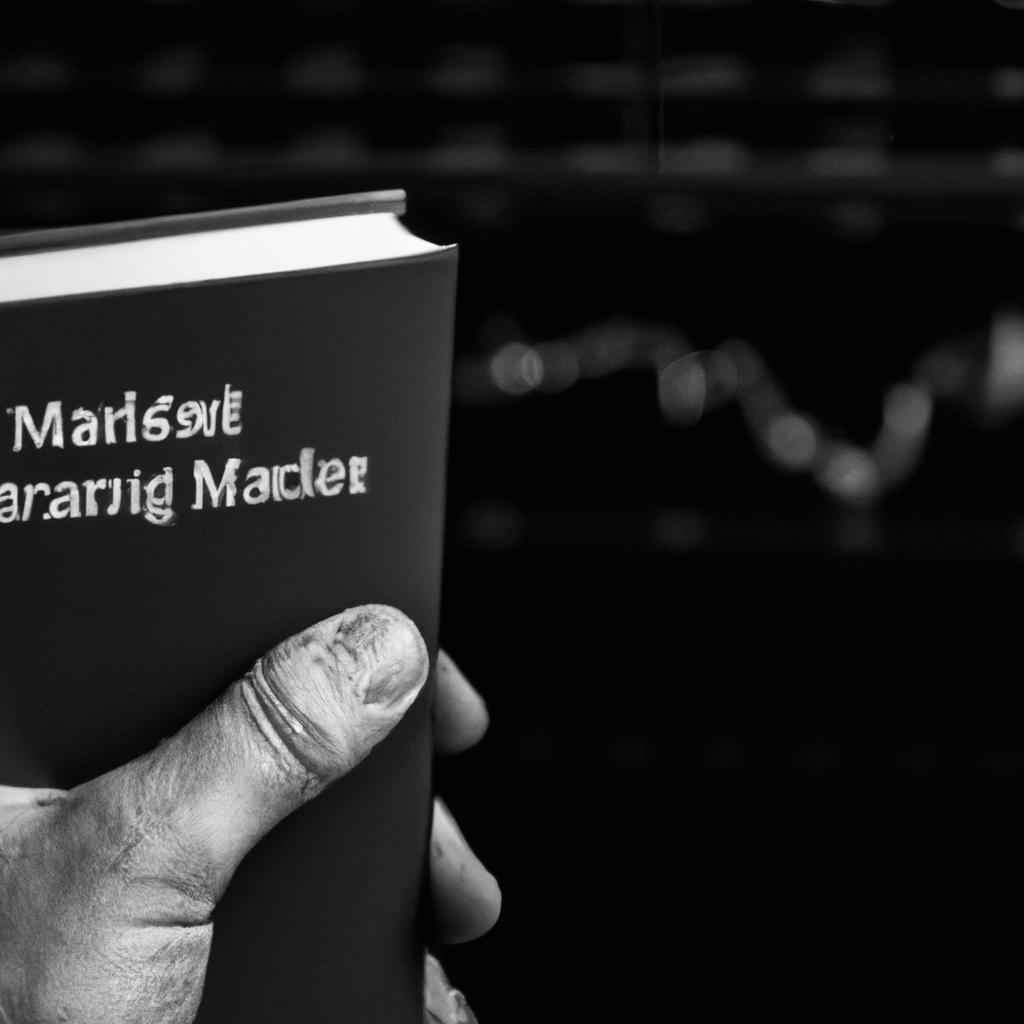

Financial derivatives, such as futures and options contracts, play a crucial role in modern financial markets. For those new to the world of trading and investing, understanding the basics of these instruments is essential. Fortunately, there are comprehensive guides available, such as "Mastering the Basics of Futures and Options Trading: A Comprehensive Guide to Financial Derivatives," that can serve as valuable resources for beginners.

This guide provides a detailed overview of financial derivatives, focusing specifically on futures and options trading. It covers the fundamental concepts, terminology, and mechanics involved in these types of contracts. By explaining the intricacies of futures contracts, which are agreements to buy or sell an asset at a predetermined price and date, the guide helps readers grasp the essentials of this derivative instrument.

Additionally, the guide delves into options trading, which involves the right, but not the obligation, to buy or sell an asset at a predetermined price within a specific timeframe. It explains the various types of options contracts, including call and put options, and helps readers understand how these instruments can be used to hedge risk or speculate on market movements.

"Mastering the Basics of Futures and Options Trading" also provides practical examples and case studies to enhance comprehension and illustrate real-life scenarios. It equips beginners with the necessary knowledge to navigate the complexities of financial derivatives and make informed investment decisions.

The guide's beginner-friendly approach ensures that even individuals with limited prior knowledge of stock derivatives can grasp the concepts presented. It breaks down complex topics into easily digestible sections, gradually building the reader's understanding from the ground up. From learning about the mechanics of futures and options contracts to exploring advanced trading strategies, this comprehensive guide covers it all.

For those interested in futures and options trading, "Mastering the Basics of Futures and Options Trading: A Comprehensive Guide to Financial Derivatives" is an invaluable resource. By acquiring a solid foundation in these financial instruments, beginners can gain the confidence and knowledge necessary to navigate the world of derivatives trading successfully. Whether it's understanding the basics of futures contracts, options pricing, or risk management techniques, this guide serves as a reliable companion on the journey towards becoming a proficient trader in the futures and options markets.

In conclusion, understanding and mastering the world of financial derivatives, such as futures contracts and options trading, can be a valuable asset for both beginner and experienced investors. By exploring the basics and gaining a comprehensive understanding of these stock derivatives, individuals can take advantage of the opportunities and benefits offered by futures and options trading. Whether you are a beginner seeking a beginner's guide or someone looking to delve deeper into the world of financial derivatives, there are resources available to help you navigate this complex market. With the right knowledge and strategy, financial derivatives can be a powerful tool in your investment arsenal. So, take the time to educate yourself and explore the world of futures and options trading to unlock the potential of financial derivatives for your investment success.