In today's complex financial landscape, understanding the intricacies of various investment instruments is crucial for anyone looking to succeed in the world of finance. One such instrument that has gained significant popularity in recent years is the futures contract. This article serves as a comprehensive guide for beginners, providing a clear understanding of financial derivatives, with a specific focus on futures contracts. We will explore the key features and benefits of futures contracts, delve into the world of futures and options stock derivatives, provide an overview of futures options trading, compare futures contracts to other financial derivatives, offer a step-by-step guide on getting started with futures contract trading, share strategies for successful futures options trading, and highlight important risks and considerations. Whether you are a seasoned investor or just starting out, this article aims to equip you with the knowledge and insights needed to navigate the world of futures contracts confidently.

1. Introduction to Financial Derivatives: A Beginner’s Guide to Futures Contract

Financial derivatives are complex financial instruments that derive their value from an underlying asset. They are commonly used for hedging against potential price fluctuations, speculating on future price movements, or simply gaining exposure to certain asset classes. One popular type of financial derivative is the futures contract.

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future. The underlying asset can vary, including commodities like oil or gold, financial instruments like stocks or bonds, or even market indices.

For beginners, understanding the basics of futures contracts is crucial. They provide an opportunity to participate in the financial markets without directly owning the underlying asset. Instead, investors can speculate on the future price movement of the asset, either by taking a long (buy) or short (sell) position.

Futures contracts are standardized, meaning they have specific terms and conditions that are agreed upon by both parties. These include the quantity of the underlying asset, the price at which it will be bought or sold (known as the futures price), the delivery date, and the settlement method. The standardized nature of futures contracts ensures transparency and liquidity in the market.

One key advantage of futures contracts is leverage. Investors can control a large position in the underlying asset with a relatively small amount of capital. This amplifies potential gains, but it also increases the risk of losses. Therefore, it is essential for beginners to fully understand the risks associated with futures trading and develop a risk management strategy.

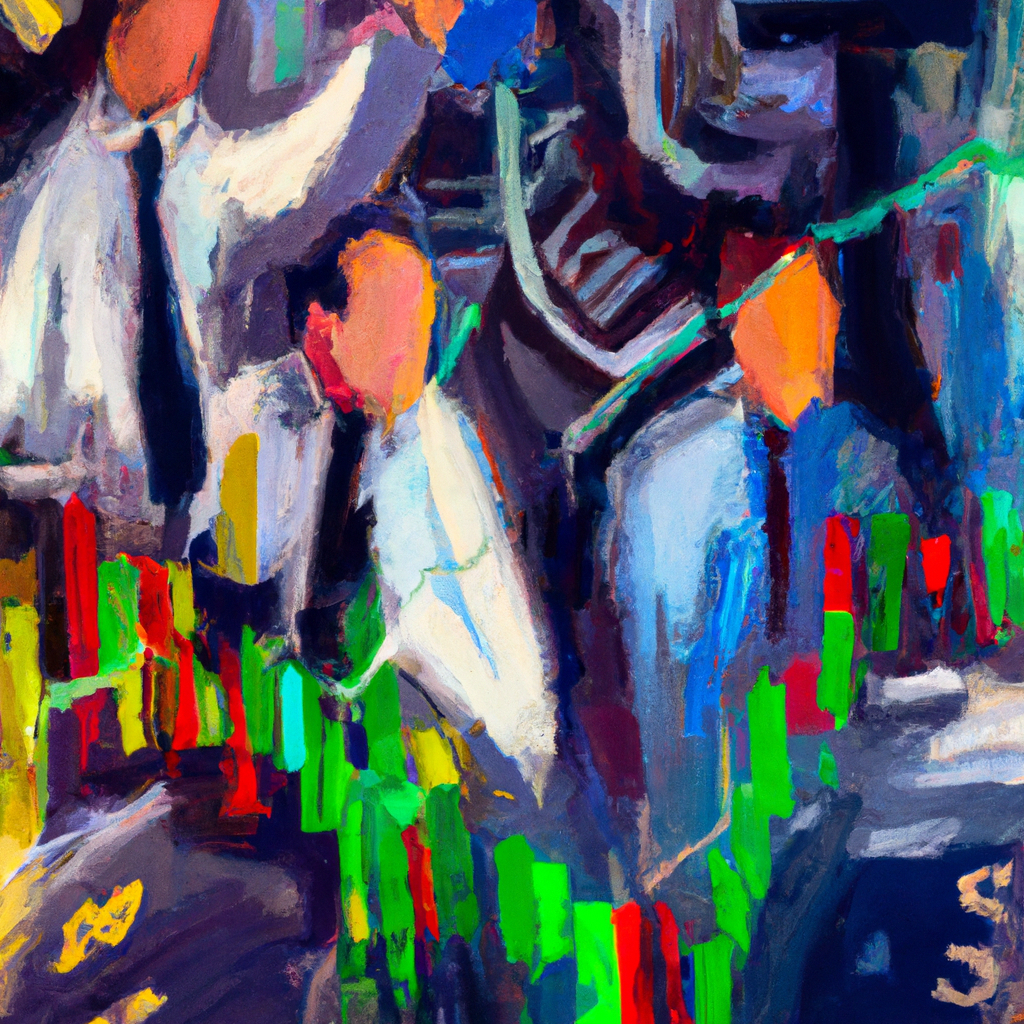

Futures contracts are commonly used by various market participants, including speculators, hedgers, and arbitrageurs. Speculators aim to profit from price movements by taking positions based on their market predictions. Hedgers, on the other hand, use futures contracts to protect themselves against potential losses arising from adverse price movements. Arbitrageurs exploit price discrepancies between different markets or related instruments to lock in risk-free profits.

Trading futures contracts can be done through various exchanges, such as the Chicago Mercantile Exchange (CME) or the Intercontinental Exchange (ICE). These exchanges provide a centralized marketplace where buyers and sellers can come together to trade futures contracts. Additionally, futures contracts can also be traded through online platforms or brokerage firms.

In conclusion, futures contracts are a type of financial derivative that allows investors to speculate on the future price movements of various assets. They offer leverage, liquidity, and the ability to hedge against potential losses. However, beginners should thoroughly educate themselves about futures trading, including understanding the risks involved, before engaging in this type of investment.

2. Understanding Futures Contract: Key Features and Benefits

A futures contract is a type of financial derivative that allows individuals or investors to buy or sell an asset at a predetermined price on a specified future date. It is a popular tool used in the financial market for hedging, speculation, and risk management purposes.

One key feature of a futures contract is its standardized nature. Unlike other financial instruments, futures contracts have specific contract sizes, delivery dates, and settlement procedures. This standardization ensures transparency and facilitates easy trading on various exchanges.

One of the major benefits of futures contracts is their ability to provide leverage. With a relatively small amount of capital, investors can control a larger quantity of the underlying asset. This leverage amplifies potential gains, but it also increases the risk of losses. Therefore, it is important for beginners to understand and manage the risks associated with futures contracts.

Futures contracts offer several advantages over other financial instruments. Firstly, they provide a high level of liquidity, meaning there are always buyers and sellers in the market. This allows for easy entry and exit from positions, ensuring efficient trading.

Secondly, futures contracts allow investors to diversify their portfolios. They provide exposure to a wide range of assets, including commodities, currencies, stock indices, and interest rates. This diversification helps to spread risk and potentially enhance returns.

Furthermore, futures contracts offer flexibility in terms of trading strategies. Investors can either take a long position (buying the contract with the expectation that the price will rise) or a short position (selling the contract with the expectation that the price will fall). This versatility allows for profit potential in both rising and falling markets.

Lastly, futures contracts provide price discovery and transparency. The continuous trading and publicly available price information enable market participants to gauge the fair value of the underlying asset. This information is crucial for making informed investment decisions.

In summary, futures contracts are important financial derivatives that offer key features and benefits. They provide leverage, liquidity, diversification, flexibility, and price transparency. As a beginner, it is essential to understand these aspects and seek appropriate guidance when venturing into futures and options stock derivatives or futures options trading.

3. Exploring the World of Futures & Options Stock Derivatives

Financial derivatives are complex financial instruments that derive their value from an underlying asset. One of the most popular types of financial derivatives is the futures contract. A futures contract is an agreement between two parties to buy or sell a specific asset, such as commodities, currencies, or stocks, at a predetermined price and date in the future.

For beginners, understanding futures contracts can be a bit overwhelming. However, with a basic understanding of how these contracts work, individuals can navigate the world of futures and options stock derivatives more confidently. Here, we will explore the key aspects of futures and options stock derivatives to provide a beginner's guide to futures options trading.

Futures and options stock derivatives are financial instruments that allow investors to speculate on the price movements of underlying stocks without actually owning them. These derivatives provide investors with an opportunity to profit from the price fluctuations of stocks without the need for significant capital investment.

In futures options trading, investors have the option to either buy or sell a futures contract. If an investor believes that the price of the underlying stock will rise, they can buy a futures contract, known as a long position. On the other hand, if they anticipate a decline in the stock price, they can sell a futures contract, known as a short position.

The advantage of trading futures and options stock derivatives is the leverage they offer. With a relatively small initial investment, investors can control a larger position in the market. This means that even small price movements in the underlying stock can result in significant profits or losses.

However, it is important for beginners to exercise caution when trading futures and options stock derivatives. The leverage can magnify losses as well, making it crucial to manage risk effectively. Developing a clear risk management strategy and understanding the potential risks involved is essential to succeed in futures options trading.

To get started with futures and options stock derivatives, beginners should consider opening an account with a reputable brokerage firm that offers futures trading. It is also advisable to educate oneself through online tutorials, courses, and reading materials specifically designed for beginners in futures options trading. Familiarizing oneself with various trading strategies and monitoring market trends can also enhance the chances of success.

In conclusion, futures and options stock derivatives provide investors with an avenue to participate in the financial markets and profit from price movements without actually owning the underlying assets. While these instruments offer significant opportunities, it is crucial for beginners to approach futures options trading with caution and a solid understanding of the associated risks. With proper education, risk management, and practice, beginners can navigate the world of futures and options stock derivatives and potentially achieve financial success.

4. The Basics of Futures Options Trading: A Comprehensive Overview

Futures options trading is an essential component of the financial derivatives market, providing investors with a unique opportunity to speculate on the future price movement of various assets. As a beginner, understanding the basics of futures options trading is crucial to navigate this complex market successfully.

A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future. It serves as a standardized agreement, ensuring that both parties fulfill their obligations. Futures contracts are commonly used to trade commodities like oil, gold, or agricultural products, but they can also involve financial instruments such as stock indices or currencies.

In the world of futures options trading, investors have the right, but not the obligation, to buy or sell the underlying asset specified in the futures contract. These options provide flexibility for traders as they can choose whether to exercise the contract or let it expire worthless. The value of a futures option is derived from the price movement of the underlying asset. If the asset's price is expected to rise, investors may choose a call option, allowing them to purchase the asset at a predetermined price. Conversely, if the price is expected to decline, put options enable investors to sell the asset at a predetermined price.

Futures options trading offers several advantages for investors. Firstly, it provides leverage, allowing traders to control a larger position with a smaller amount of capital. This amplifies potential profits, but it also increases the risk of losses. Secondly, futures options provide a hedge against price volatility. Investors can take positions that offset potential losses in their physical holdings, ensuring protection against adverse market movements. Lastly, futures options offer liquidity, as they can be readily bought or sold in the market.

To engage in futures options trading, beginners must familiarize themselves with the essential concepts and strategies. A comprehensive understanding of the factors influencing options pricing, such as time decay and implied volatility, is crucial. Additionally, learning different trading strategies, including spreads, straddles, and strangles, can help investors manage risk and maximize their potential returns.

In conclusion, futures options trading is a vital aspect of the financial derivatives market, providing investors with opportunities to profit from the future price movement of various assets. As a beginner, it is essential to grasp the basics of futures options trading to navigate this complex market successfully. By understanding the mechanics of futures contracts, the flexibility of options, and employing appropriate strategies, investors can participate in this dynamic market and potentially achieve their financial goals.

5. Futures Contract vs. Other Financial Derivatives: A Comparative Analysis

A futures contract is a type of financial derivative that allows traders to speculate on the future price of an underlying asset. However, it is important to understand how futures contracts differ from other financial derivatives to fully grasp their unique characteristics and advantages.

One major distinction between futures contracts and other financial derivatives is their standardized nature. Unlike options or swaps, futures contracts have specific terms and conditions that are pre-set by an exchange. This standardization ensures that all parties involved have a clear understanding of the contract's obligations, including the quantity, quality, and delivery date of the underlying asset.

Additionally, futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME), providing transparency and liquidity. This means that traders can easily enter and exit positions without the need for a counterparty, making futures contracts more accessible to beginners.

Compared to other financial derivatives, futures contracts also have a higher level of leverage. Traders are required to only deposit a small percentage of the contract's value, known as the margin, which allows them to control a larger position. This leverage amplifies both potential profits and losses, making futures contracts a more risky investment option.

Furthermore, futures contracts are primarily used for hedging purposes, mitigating risks associated with price fluctuations. For example, a farmer can enter into a futures contract to sell their crop at a predetermined price, ensuring stability and protection against adverse market movements. Other financial derivatives, such as options or swaps, offer more flexibility in terms of risk management strategies.

In terms of trading and investment strategies, futures contracts are commonly used for short-term speculation and day trading. Traders can take advantage of price movements in various markets, including commodities, currencies, and stock indices, using futures contracts. Options, on the other hand, provide investors with the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified period.

In conclusion, futures contracts differ from other financial derivatives in terms of standardization, trading environment, leverage, risk management, and investment strategies. While futures contracts offer beginners a structured and accessible way to participate in the market, it is crucial for traders to fully understand their characteristics and associated risks before engaging in futures options trading.

6. How to Get Started with Futures Contract Trading: Step-by-Step Guide

If you're a beginner interested in trading financial derivatives, specifically futures contracts, this step-by-step guide will help you get started. Futures contracts are popular instruments in the world of trading, providing investors with the opportunity to speculate on the future price of various assets, including commodities, stocks, currencies, and more. Here's how you can begin your journey into futures contract trading:

Step 1: Educate Yourself

Before diving into futures contract trading, it's crucial to gain a solid understanding of the basics. Familiarize yourself with the concept of futures contracts, how they work, and the risks involved. There are numerous online resources, courses, and books available that can help you grasp the fundamentals of futures trading.

Step 2: Choose a Futures Broker

Selecting a reliable futures broker is essential for your trading journey. Look for a broker that offers competitive commission rates, a user-friendly trading platform, advanced charting tools, and access to a wide range of futures markets. Ensure that the broker is regulated by a reputable financial authority to protect your investments.

Step 3: Open a Trading Account

Once you've chosen a futures broker, begin the process of opening a trading account. This typically involves completing an application, providing the necessary identification and financial information, and funding your account. Most brokers offer different types of accounts, so choose the one that aligns with your trading goals and risk tolerance.

Step 4: Learn the Trading Platform

Take the time to familiarize yourself with the trading platform provided by your broker. Explore its features, understand how to execute trades, analyze charts, and monitor your positions. Practice using the platform's demo account or paper trading feature to gain confidence before risking real money.

Step 5: Develop a Trading Plan

A well-defined trading plan is crucial for success in futures contract trading. Determine your financial goals, risk tolerance, and preferred trading strategy. Consider factors such as the time frame you want to trade in, the assets you're interested in, and the amount of capital you're willing to risk per trade. Stick to your plan and avoid impulsive decisions.

Step 6: Start Trading

Once you have educated yourself, selected a broker, opened an account, familiarized yourself with the trading platform, and developed a trading plan, it's time to dive into the world of futures contract trading. Begin by executing small trades, gradually increasing your position sizes as you gain experience and confidence. Monitor your trades regularly and stay updated with market news and trends that may impact your positions.

Remember, futures contract trading involves substantial risks, and it's essential to manage your risks effectively. Continuously educate yourself, adapt your trading strategies as needed, and never invest more than you can afford to lose. With time, practice, and perseverance, you can navigate the futures market and potentially reap the benefits of this exciting financial derivative.

7. Strategies for Successful Futures Options Trading: Tips and Techniques

When it comes to futures options trading, having a solid strategy is crucial for success. Whether you are a beginner or an experienced trader, implementing the right tips and techniques can significantly enhance your trading outcomes. In this section, we will explore some strategies that can help you navigate the world of futures options trading.

1. Understand the Basics: Before diving into futures options trading, it is essential to have a strong understanding of financial derivatives, especially futures contracts. Educate yourself by reading a beginner's guide or taking courses that cover futures and options stock derivatives. This knowledge will provide a solid foundation for developing effective trading strategies.

2. Research and Analyze: Like any other form of trading, conducting thorough research and analysis is crucial in futures options trading. Stay updated with market news, economic indicators, and trends that influence the underlying asset of your futures contract. Utilize technical and fundamental analysis to identify potential entry and exit points.

3. Set Clear Goals and Risk Management: Define your trading goals and risk tolerance before entering any trade. Determine how much you are willing to invest and the maximum loss you can afford. Implement stop-loss orders to limit potential losses and take-profit orders to secure profits. Setting clear goals and managing risks will help you stay disciplined and avoid impulsive decisions.

4. Diversify Your Portfolio: Diversification is a key strategy to mitigate risks in futures options trading. Avoid putting all your eggs in one basket by spreading your investments across different asset classes, industries, or even geographical regions. This way, if one trade does not go as planned, the losses can be offset by gains in other positions.

5. Practice Patience and Discipline: Successful futures options trading requires patience and discipline. Avoid chasing quick profits or getting emotionally attached to trades. Stick to your pre-determined trading plan and avoid impulsive decisions based on fear or greed. Maintaining discipline and patience will help you ride out market fluctuations and make rational trading decisions.

6. Utilize Technical Tools: Technical analysis tools can provide valuable insights into market trends and potential price movements. Use indicators, such as moving averages, MACD, or RSI, to identify entry and exit points. Combine different technical tools to confirm signals and increase the probability of successful trades.

7. Continuous Learning and Adaptation: The world of futures options trading is constantly evolving. Stay updated with market trends, new trading strategies, and technological advancements. Attend webinars, workshops, or seminars to enhance your knowledge and skills. Continuous learning and adaptation will help you stay ahead of the curve and make informed trading decisions.

In conclusion, futures options trading can be a lucrative endeavor if approached with the right strategies. By understanding the basics, conducting thorough research, setting clear goals, diversifying your portfolio, practicing patience and discipline, utilizing technical tools, and continuously learning, you can increase your chances of success in this dynamic market. Remember, it is important to seek advice from a financial professional before making any investment decisions.

8. Risks and Considerations in Futures Contract Trading: Important Factors to Know

When engaging in futures contract trading, it is crucial for beginners to understand the risks and considerations associated with this form of investment. Futures contracts are financial derivatives that allow traders to buy or sell an asset at a predetermined price and date in the future.

One important factor to consider is the high level of leverage involved in futures contract trading. Leverage allows traders to control a large amount of assets with a relatively small investment. While this can lead to significant profits, it also amplifies the potential losses. Traders must be prepared to monitor their positions closely and have a clear risk management strategy in place.

Another risk to be aware of is price volatility. Futures markets can be highly volatile, with prices fluctuating rapidly due to various factors such as economic news, geopolitical events, and market sentiment. Traders should be prepared for sudden price movements that can result in substantial gains or losses.

Liquidity is also an important consideration in futures contract trading. Some markets may have low liquidity, which can make it difficult to enter or exit positions at desired prices. Traders should carefully evaluate the liquidity of the specific futures contracts they wish to trade to ensure they can easily enter and exit positions.

Furthermore, it is essential to understand the concept of counterparty risk in futures contract trading. Unlike trading on regulated exchanges, where the clearinghouse acts as the counterparty to all trades, over-the-counter (OTC) futures contracts involve direct transactions between two parties. This introduces the risk that the counterparty may default on their obligations. Traders should carefully assess the creditworthiness and reputation of their counterparties before entering into any OTC futures contracts.

Lastly, beginners should consider the potential impact of external factors on futures contract trading. Macroeconomic indicators, government policies, and global events can significantly influence futures markets. It is crucial to stay informed about these factors and their potential impact on the asset being traded.

In conclusion, futures contract trading offers potential opportunities for profit, but it also carries significant risks. Understanding the risks associated with leverage, price volatility, liquidity, counterparty risk, and external factors is crucial for beginners. By being aware of these important considerations, traders can develop effective risk management strategies and increase their chances of success in futures contract trading.