Financial derivatives play a crucial role in today's complex financial markets. These instruments, such as futures contracts and options, allow investors to hedge against risk, speculate on price movements, and gain exposure to various assets. However, for beginners, understanding financial derivatives can be quite daunting. In this article, we will provide a comprehensive beginner's guide to futures contracts, explore the world of stock derivatives including futures and options trading, and provide a detailed overview of financial derivatives and futures contracts. Whether you are a novice investor or looking to expand your knowledge in this area, this article will help you navigate the intricacies of financial derivatives and empower you to make informed investment decisions. So, let's dive into the world of financial derivatives and discover the potential they hold for your financial portfolio.

1. Understanding Financial Derivatives: A Beginner’s Guide to Futures Contracts

Financial derivatives are complex financial instruments that derive their value from an underlying asset or security. One popular type of financial derivative is a futures contract. In this beginner's guide, we will unravel the mysteries of futures contracts and help you understand how they work.

A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a future date. This asset can be commodities such as oil, gold, or agricultural products, or even financial instruments like stocks or bonds. The predetermined price is known as the futures price, and the future date is called the expiration date.

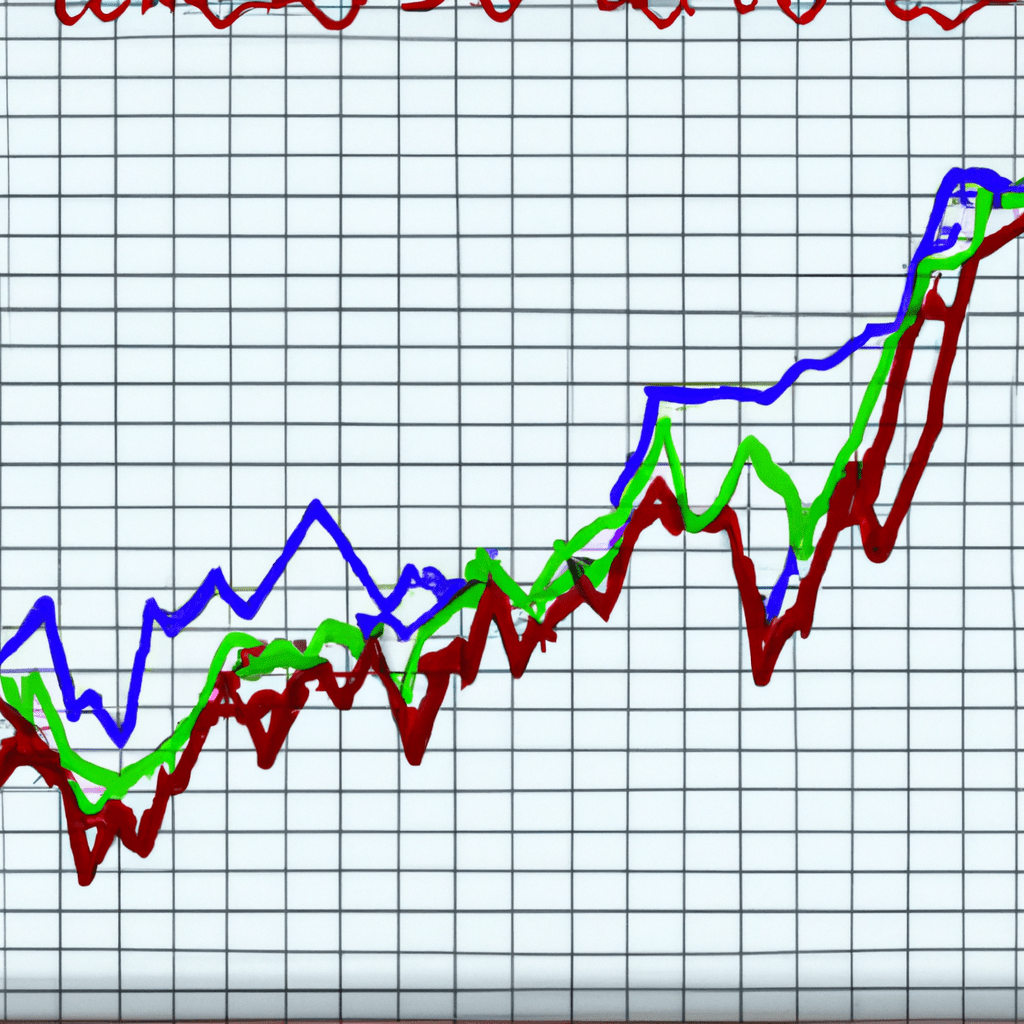

Futures contracts serve several purposes for market participants. They provide a way to hedge against price fluctuations, speculate on future price movements, and enable the transfer of risk between parties. For example, if you are a farmer who wants to lock in a price for your crop before harvesting, you can enter into a futures contract to sell your crop at a fixed price. This way, you are protected from potential price declines.

To trade futures contracts, you don't need to own the underlying asset. Instead, you only need to deposit a small amount of money, known as the margin, which acts as collateral. This leverage allows traders to control a larger amount of the underlying asset with a smaller investment. However, it's important to note that leverage can amplify both profits and losses.

Futures contracts are traded on exchanges, where buyers and sellers come together to execute trades. These exchanges act as intermediaries, ensuring the smooth functioning of the market and providing a transparent platform for trading. Some well-known futures exchanges include the Chicago Mercantile Exchange (CME) and the New York Mercantile Exchange (NYMEX).

Trading futures contracts involves understanding key terms and concepts. For instance, the tick size refers to the minimum price movement allowed for a contract. Additionally, contract specifications such as contract size, expiration date, and settlement method vary depending on the underlying asset.

It's also important to differentiate between futures and options contracts. While both are derivatives, options give the buyer the right, but not the obligation, to buy or sell the underlying asset at a specified price within a specific timeframe. Futures contracts, on the other hand, require both parties to fulfill the contract obligations.

In conclusion, futures contracts are an essential component of financial derivatives. They provide a way to manage risk, speculate on price movements, and facilitate the transfer of risk. By understanding the basics of futures contracts, beginners can gain a solid foundation for further exploration into the world of financial derivatives. Whether you are interested in futures and options trading or stock derivatives, futures contracts are an important tool to consider in your investment strategy.

2. Exploring Stock Derivatives: An Introduction to Futures and Options Trading

Financial derivatives are a complex but essential aspect of the global financial market. Among the various types of derivatives, stock derivatives play a significant role in providing investors with opportunities to hedge risks and speculate on future market movements. In this section, we will delve into the world of stock derivatives by introducing two popular forms of trading: futures and options.

Futures contracts are one of the most common types of financial derivatives. These agreements are essentially a promise to buy or sell an underlying asset, such as stocks, at a predetermined price and date in the future. Unlike trading stocks directly, futures contracts enable investors to speculate on the price movement of an asset without owning the asset itself. This feature makes futures contracts attractive to both hedgers and speculators.

For beginners, understanding the mechanics of futures trading is crucial. When entering into a futures contract, traders are required to deposit a small percentage of the contract's total value, known as the margin. This margin acts as collateral and ensures that both parties involved in the contract fulfill their obligations. It's important to note that futures contracts have expiration dates, after which the contract must be settled. Settlement can occur through physical delivery of the underlying asset or through cash settlement, depending on the contract's specifications.

Options trading is another form of stock derivatives that offers investors flexibility and the potential for higher returns. An option provides the holder with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. Unlike futures contracts, options trading allows investors to choose whether they want to exercise their right or let the option expire.

There are two types of options: call options and put options. Call options give the holder the right to buy the underlying asset, while put options provide the right to sell the asset. The predetermined price at which the option can be exercised is called the strike price. Options traders pay a premium for the right to hold the option, which is determined by factors such as the stock's price, volatility, time until expiration, and the strike price.

For beginners, understanding the basics of futures and options trading is essential before venturing into the world of stock derivatives. It is important to conduct thorough research and seek guidance from reputable sources or financial advisors to ensure a solid understanding of the risks and potential rewards associated with these trading instruments.

In summary, futures and options trading are integral aspects of stock derivatives. These instruments provide investors with opportunities to hedge risks and speculate on future market movements. By familiarizing themselves with the mechanics of futures and options trading, beginners can navigate the complex world of financial derivatives more effectively.

3. Mastering the Basics: A Comprehensive Overview of Financial Derivatives and Futures Contracts

Financial derivatives and futures contracts are complex financial instruments that are widely used in the global financial markets. They play a crucial role in managing risk, hedging positions, and speculating on price movements. For beginners, understanding the basics of financial derivatives and futures contracts is essential to navigate and make informed decisions in the market.

To start with, let's explore what financial derivatives are. Essentially, a financial derivative is a contract between two parties that derives its value from an underlying asset. This underlying asset can be a commodity, currency, bond, stock, or even an index. The value of the derivative is determined by the fluctuations in the price of the underlying asset.

Futures contracts are one of the most common types of financial derivatives. They are standardized agreements to buy or sell a specific asset at a predetermined price and date in the future. These contracts are traded on exchanges, providing a transparent and regulated marketplace for buyers and sellers.

In a futures contract, the buyer agrees to purchase the underlying asset, and the seller agrees to deliver it at the specified price and date. The key feature of futures contracts is that both parties are obligated to fulfill their contractual obligations. This makes them different from options contracts, where the buyer has the right, but not the obligation, to exercise the contract.

Financial derivatives, including futures contracts, serve various purposes for market participants. They allow businesses to hedge against price volatility, protecting them from potential losses. For example, a farmer can use a futures contract to lock in a price for their crops, ensuring a certain level of income regardless of price fluctuations.

Investors and traders also utilize financial derivatives for speculation and profit-making opportunities. By taking positions in futures contracts, they can capitalize on price movements in the underlying assets. This allows them to potentially profit from both rising and falling markets.

Trading in financial derivatives and futures contracts involves a certain level of complexity and risk. It requires a deep understanding of the underlying assets, market dynamics, and the factors that drive price movements. Therefore, it is crucial for beginners to undertake comprehensive research and education before engaging in futures and options trading.

There are several resources available to beginners, such as books, online courses, and educational materials provided by exchanges and brokerage firms. These resources can help individuals grasp the basics of financial derivatives, learn about different strategies, and develop risk management techniques.

In conclusion, financial derivatives, particularly futures contracts, are valuable tools for managing risk and speculating on price movements in the financial markets. Beginners should take the time to master the basics, including understanding the underlying assets, contract specifications, and the risks involved. With proper education and a cautious approach, individuals can navigate the world of financial derivatives and potentially benefit from the opportunities they offer.

In conclusion, financial derivatives, specifically futures contracts, offer individuals and businesses the opportunity to hedge against price fluctuations and manage risk. This article has provided a beginner's guide to understanding financial derivatives, explored stock derivatives such as futures and options trading, and offered a comprehensive overview of the basics of financial derivatives and futures contracts. By mastering the fundamentals and utilizing these tools effectively, investors can navigate the complex world of financial derivatives and potentially enhance their investment strategies. Whether you are a beginner or an experienced trader, it is crucial to continue learning and staying updated on the latest developments in the field of financial derivatives and futures options trading.