Welcome to our comprehensive guide on navigating the stock market and capitalizing on the bull market by investing in blue-chip stocks. Whether you are a beginner looking to dip your toes into the world of stock trading or an experienced investor hoping to maximize your profits, this article will provide you with valuable insights and tips for buying and selling shares in the stock market. From understanding the basics of share dealing to uncovering strategies for investing in blue-chip stocks, we will unlock the secrets to success in the ever-evolving world of the stock market. So, let's dive in and discover how you can make the most out of your stock market investments.

1. “Navigating the Stock Market: A Beginner’s Guide to Buying and Selling Shares”

Navigating the Stock Market: A Beginner's Guide to Buying and Selling Shares

Investing in the stock market can be an exciting and profitable venture, but for beginners, it can also be overwhelming and confusing. Understanding the basics of buying and selling shares is essential to navigate the stock market successfully. This beginner's guide aims to provide valuable insights and tips to help individuals make informed decisions when entering the world of stock market investing.

Before jumping into buying and selling shares, it is crucial to have a clear understanding of the stock market itself. The stock market is a platform where investors can buy and sell shares of publicly-traded companies. Shares represent ownership in a company and provide investors with the opportunity to participate in the company's growth and profitability.

To start buying and selling shares, individuals need a brokerage account. A brokerage account acts as an intermediary between investors and the stock market. It allows investors to place buy and sell orders for shares of various companies. There are numerous online brokerage platforms available, offering different features, fees, and services. It is essential to select a reliable and reputable brokerage that suits an individual's investment needs.

Once a brokerage account is set up, investors can begin buying shares. Before making any investment decisions, it is crucial to conduct thorough research on the company or companies of interest. Analyzing financial statements, quarterly reports, and industry trends can provide valuable insights into a company's financial health and growth prospects. Investors should also consider the company's competitive position, management team, and any potential risks.

When purchasing shares, investors have two primary strategies: trading and investing. Trading involves frequent buying and selling of shares, aiming to profit from short-term price fluctuations. On the other hand, investing focuses on long-term growth and involves buying shares with the intention of holding them for an extended period, usually years. Both strategies have their pros and cons, and it is essential to align them with individual risk tolerance and investment goals.

Selling shares is another crucial aspect of stock market participation. Investors may decide to sell shares for various reasons, such as realizing profits, cutting losses, or rebalancing their portfolio. It is important to monitor the market and individual stocks regularly to make informed selling decisions. Understanding market trends, economic indicators, and company-specific news can help investors time their sell orders effectively.

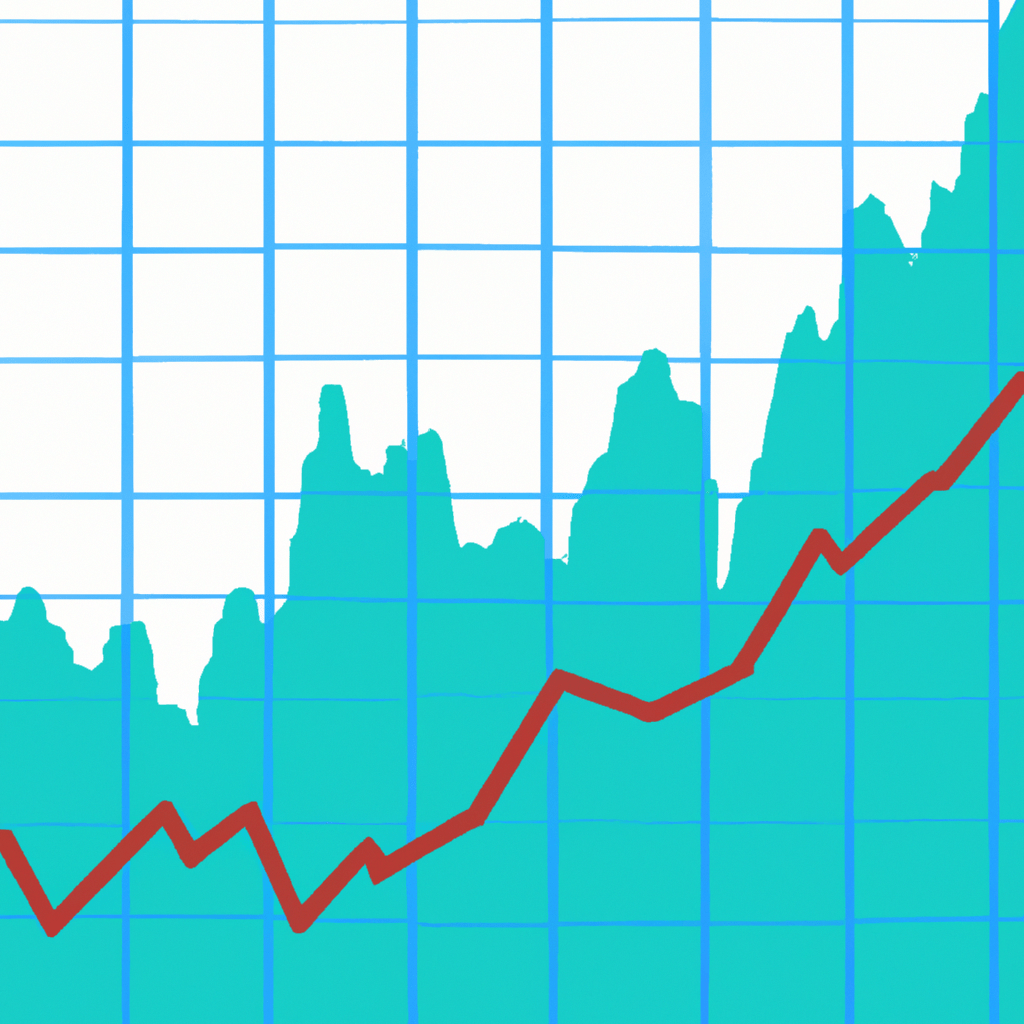

In a bull market, which refers to a period of rising stock prices, it is generally easier to sell shares at a profit. However, during market downturns or bear markets, selling shares may result in losses. Therefore, it is crucial for beginners to develop a disciplined approach to buying and selling shares, taking into account their risk tolerance and long-term investment objectives.

When building a stock portfolio, beginners often hear about blue-chip stocks. Blue-chip stocks are shares of well-established, financially stable companies with a history of reliable performance. These companies are typically leaders in their respective industries and have a strong market presence. Investing in blue-chip stocks can be a relatively safer option for beginners, as they tend to be more resilient during market downturns.

In conclusion, navigating the stock market requires a solid understanding of buying and selling shares. Beginners should begin by familiarizing themselves with the basics of the stock market, setting up a brokerage account, and conducting thorough research on potential investments. Having a clear investment strategy, monitoring the market, and understanding the significance of blue-chip stocks can help beginners make informed decisions and navigate the stock market with confidence.

2. “Capitalizing on the Bull Market: Strategies for Investing in Blue-Chip Stocks”

When it comes to investing in the stock market, there are various strategies that can be employed depending on the prevailing market conditions. One such strategy is capitalizing on the bull market by investing in blue-chip stocks. Blue-chip stocks are shares of large, well-established companies with a history of stable earnings and a strong market presence.

Investing in blue-chip stocks during a bull market can be a lucrative move for investors. A bull market is characterized by rising stock prices and an overall optimistic market sentiment. During this period, investors are generally more confident and willing to take on more risk, which can lead to higher returns on their investments.

One strategy for investing in blue-chip stocks during a bull market is to focus on companies that have a solid track record of consistent performance. These companies are often leaders in their respective industries and have a proven ability to weather economic downturns. By investing in these blue-chip stocks, investors can take advantage of their stability and potential for long-term growth.

Another strategy is to diversify your portfolio by investing in a mix of blue-chip stocks from different sectors. This helps to spread the risk and minimize the impact of any potential downturn in a specific industry. Diversification also allows investors to benefit from the growth potential of various sectors, which can help maximize returns.

Investors can also consider the option of buying blue-chip stocks when they are undervalued in the market. This means that the stock price is lower than its intrinsic value, providing an opportunity for investors to buy shares at a discounted price. When the market eventually recognizes the true value of these stocks, their prices are likely to increase, resulting in capital gains for the investors.

It is important for investors to conduct thorough research and analysis before investing in blue-chip stocks during a bull market. This includes studying the company's financial statements, market trends, and assessing the overall economic conditions. Additionally, keeping an eye on news and updates related to the company and its industry can provide valuable insights for making informed investment decisions.

In conclusion, capitalizing on the bull market by investing in blue-chip stocks can be a profitable strategy for investors. By focusing on stable companies with a strong market presence, diversifying the portfolio, and identifying undervalued stocks, investors can increase their chances of earning significant returns in the stock market. However, it is important to approach this strategy with caution and conduct thorough research to make informed investment decisions.

3. “Unlocking the Secrets of Share Dealing: Tips for Maximizing Profits in the Stock Market”

Unlocking the Secrets of Share Dealing: Tips for Maximizing Profits in the Stock Market

Investing in the stock market can be a daunting task for beginners and experienced investors alike. However, with the right knowledge and strategies, it is possible to unlock the secrets of share dealing and maximize profits in this dynamic market. Whether you are looking to sell shares, invest in blue-chip stocks, or take advantage of a bull market, here are some tips to help you navigate the stock market and increase your chances of success.

1. Conduct Thorough Research:

Before diving into any investment, it is crucial to conduct thorough research on the stock market. This includes understanding the current market trends, analyzing companies of interest, and staying updated on relevant news and events. By doing so, you can make informed decisions and avoid making impulsive investment choices.

2. Diversify Your Portfolio:

One of the key strategies for maximizing profits in the stock market is diversification. Rather than putting all your eggs in one basket, consider spreading your investments across different sectors, industries, and asset classes. This helps mitigate risks and protects your portfolio from significant losses if one investment underperforms. In a volatile market, diversification can provide stability and potentially enhance your overall returns.

3. Set Realistic Goals:

Setting realistic financial goals is essential when it comes to maximizing profits in the stock market. It is important to be patient and understand that investing is a long-term game. While it is tempting to chase quick gains, it is often wiser to focus on long-term growth and stability. By setting realistic goals and sticking to your investment strategy, you can avoid impulsive decisions driven by short-term market fluctuations.

4. Stay Informed and Adapt:

The stock market is constantly evolving, and it is crucial to stay informed about market trends, economic indicators, and company news. By staying up to date, you can identify emerging opportunities or potential risks that could impact your investments. Additionally, be prepared to adapt your investment strategy as market conditions change. Flexibility and the ability to adjust your portfolio accordingly are key to maximizing profits in the stock market.

5. Seek Professional Advice:

If you feel overwhelmed or lack the expertise to navigate the stock market, seeking professional advice can be beneficial. Financial advisors and investment professionals can provide guidance tailored to your specific goals and risk tolerance. They can help you identify potential investment opportunities, manage your portfolio, and provide you with valuable insights to maximize your profits.

In conclusion, unlocking the secrets of share dealing and maximizing profits in the stock market requires a combination of knowledge, strategy, and discipline. By conducting thorough research, diversifying your portfolio, setting realistic goals, staying informed, and seeking professional advice when needed, you can increase your chances of success in this dynamic market. Remember, investing in the stock market involves risks, but with careful planning and execution, it can also offer rewarding opportunities for investors.

In conclusion, the stock market can be a profitable and exciting venture for beginners and experienced investors alike. By following the tips and strategies outlined in this article, individuals can navigate the stock market with confidence and maximize their profits. Whether it's buying and selling shares, capitalizing on the bull market, or unlocking the secrets of share dealing, there are numerous opportunities to succeed in the stock market. By focusing on blue-chip stocks and utilizing smart investment strategies, individuals can position themselves for long-term success. With the right knowledge and mindset, anyone can participate in the stock market and potentially reap significant financial rewards. So, take the plunge and start your stock market journey today!