Welcome to our comprehensive guide on financial derivatives. In this article, we will provide beginners with a thorough understanding of financial derivatives and explore two key components: futures contracts and stock derivatives. Whether you are new to the world of finance or looking to expand your knowledge, this guide will unlock the potential of futures options trading and help you navigate the complex world of financial derivatives. So, let's dive in and discover the ins and outs of these essential tools for investors.

1. Understanding Financial Derivatives: A Comprehensive Guide for Beginners

Financial derivatives are complex financial instruments that derive their value from an underlying asset or a group of assets. They are widely used by investors and traders to manage risk, speculate on price movements, and enhance investment returns. In this comprehensive guide, we will provide beginners with a clear understanding of financial derivatives and their various types.

One of the most common types of financial derivatives is the futures contract. A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a specified future date. It allows market participants to hedge against price fluctuations and ensures price stability for both buyers and sellers. Beginners can benefit from futures contracts as they provide an opportunity to enter into various markets, including commodities, currencies, and stock indices.

Another important type of financial derivative is options. Options provide the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. They can be used by beginners to protect their portfolios against adverse price movements, generate income through option premiums, or speculate on price changes. Options can be further categorized into call options, which give the holder the right to buy an asset, and put options, which give the holder the right to sell an asset.

Stock derivatives are another significant aspect of financial derivatives. These derivatives are specifically linked to stocks or shares of a company. Investors can use stock derivatives such as stock options or stock futures to hedge their stock positions, speculate on price movements, or leverage their investments. Beginners can explore stock derivatives as a way to gain exposure to the stock market without actually owning the underlying shares.

Futures options trading is an advanced strategy that combines elements of both futures contracts and options. It offers traders the right, but not the obligation, to buy or sell a futures contract at a predetermined price within a specified period. This strategy provides flexibility and allows traders to trade futures contracts with limited risks. Beginners should approach futures options trading with caution and ensure they have a thorough understanding of both futures and options before engaging in this complex trading strategy.

In conclusion, financial derivatives are powerful instruments that offer numerous opportunities for beginners in the financial markets. By understanding the basics of futures contracts, options, stock derivatives, and futures options trading, beginners can navigate these complex instruments and make informed investment decisions. It is essential to conduct thorough research, seek professional guidance, and gradually gain experience in trading financial derivatives.

2. Exploring Futures Contracts: A Key Component of Financial Derivatives

Financial derivatives are a category of financial instruments that derive their value from an underlying asset. These instruments are widely used by investors and traders to hedge against price fluctuations, speculate on future market movements, and manage risk. One popular type of financial derivative is the futures contract.

A futures contract is a legally binding agreement between two parties to buy or sell an asset, such as commodities, currencies, or financial instruments, at a predetermined price and date in the future. Unlike options contracts, futures contracts require both parties to fulfill the terms of the agreement. This feature makes futures contracts a key component of financial derivatives.

For beginners in the world of futures and options trading, understanding the basics of futures contracts is essential. These contracts serve as a standardized way to trade and speculate on various assets without needing to physically possess them. They offer opportunities for profit in both rising and falling markets, making them versatile instruments for traders.

Futures contracts are often used in stock derivatives, where the underlying asset is a stock or an index. By buying or selling futures contracts on stocks, investors can gain exposure to the stock market without directly owning the shares. This allows for greater flexibility and leverage in managing investment portfolios.

One of the advantages of futures contracts is their liquidity. These contracts are traded on exchanges, providing a transparent and efficient marketplace for buyers and sellers. This liquidity ensures that investors can easily enter or exit positions, minimizing the risk of being stuck with an illiquid asset.

Moreover, futures contracts also serve as a risk management tool. By locking in prices and delivery dates in advance, businesses can protect themselves against adverse price movements in commodities or currencies. This hedging mechanism helps stabilize prices and mitigate the impact of market volatility.

In conclusion, futures contracts are a vital component of financial derivatives. They enable traders and investors to speculate, hedge, and manage risk in a wide range of markets. For beginners, understanding the basics of futures contracts is crucial to navigate the world of financial derivatives successfully. Whether one is interested in stock derivatives or other assets, futures contracts offer a versatile and liquid avenue for participation in the market.

3. Unlocking the Potential of Stock Derivatives: An Introduction to Futures Options Trading

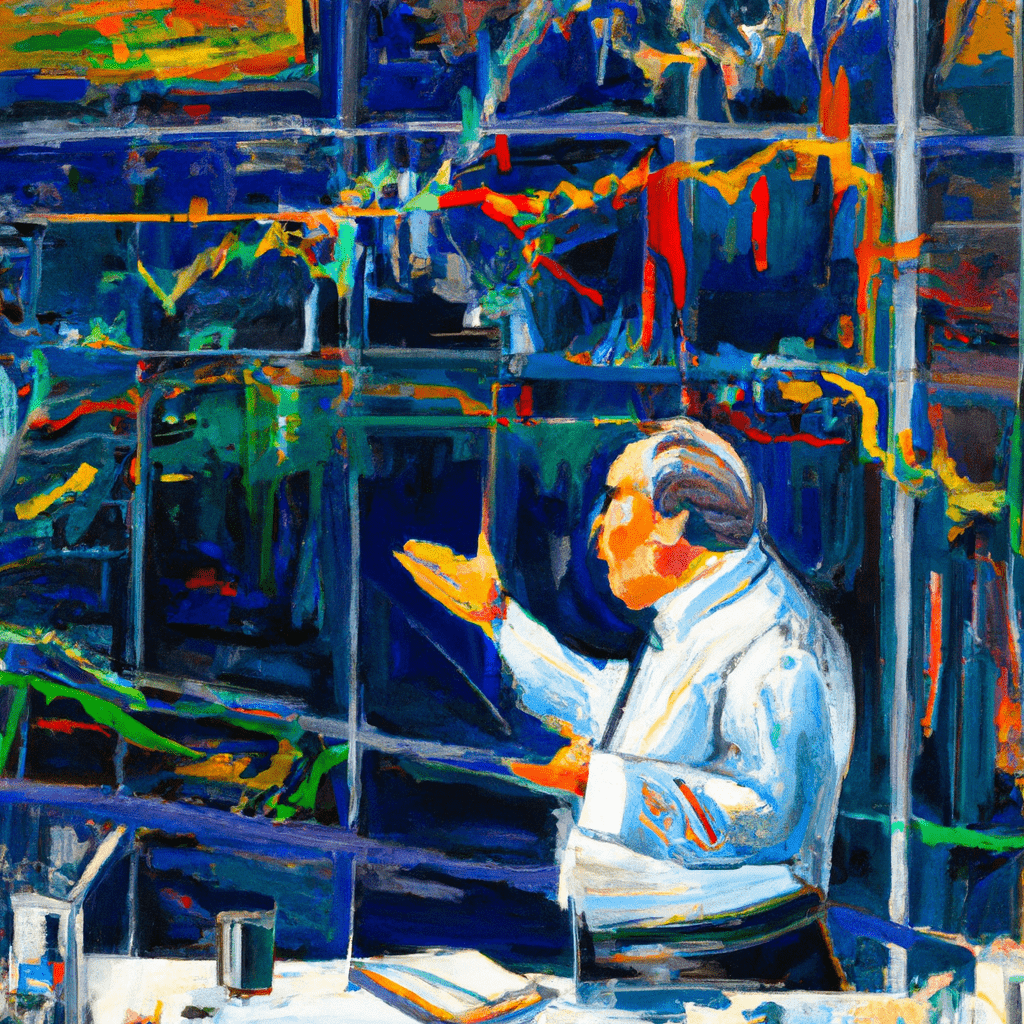

Financial derivatives are complex financial instruments that derive their value from an underlying asset, such as stocks, bonds, commodities, or currencies. These instruments are used by investors to manage risks, speculate on price movements, and enhance their investment portfolios. One type of financial derivative that has gained significant popularity is futures options trading.

Futures options trading is a form of trading that involves the use of contracts known as futures contracts. A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a future date. These contracts are standardized and traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX).

The main attraction of futures options trading is the potential for high returns. With futures options, investors have the opportunity to profit from price movements in the underlying asset without actually owning the asset itself. This allows investors to leverage their positions and maximize their potential gains.

For beginners, understanding futures options trading may seem overwhelming. However, with the right knowledge and guidance, anyone can unlock the potential of stock derivatives and participate in this exciting market. A beginners' guide to futures and options trading can provide valuable insights into the mechanics of these instruments and help individuals navigate the complexities of the market.

Stock derivatives, specifically futures options, offer several advantages for investors. Firstly, they provide a flexible way to manage risk. By using futures options, investors can hedge their existing positions and protect themselves against adverse price movements. This is particularly beneficial for institutional investors and fund managers who need to manage large portfolios and mitigate potential losses.

Secondly, futures options trading allows investors to speculate on price movements. By taking positions in futures contracts, investors can profit from both upward and downward price movements in the underlying asset. This opens up opportunities for profit regardless of the market conditions.

Lastly, stock derivatives, such as futures options, offer liquidity and diversification benefits. These instruments are actively traded, ensuring that investors can easily enter and exit positions. Additionally, futures options provide exposure to a wide range of underlying assets, allowing investors to diversify their portfolios and spread their risk.

In conclusion, futures options trading is an attractive option for investors looking to unlock the potential of stock derivatives. By understanding the mechanics of futures contracts and utilizing a beginners' guide to futures and options trading, investors can effectively manage risk, speculate on price movements, and enhance their investment portfolios. With the right knowledge and strategy, financial derivatives can be a valuable tool in an investor's arsenal.

In conclusion, financial derivatives such as futures contracts and stock derivatives can be powerful tools for investors looking to manage risk and potentially increase their returns. This comprehensive guide has provided beginners with a solid understanding of financial derivatives and their various components. By exploring futures contracts and futures options trading, investors can unlock the potential of these instruments and navigate the world of financial derivatives with confidence. Whether you are a novice or experienced investor, understanding the intricacies of financial derivatives is essential for making informed investment decisions. So, take the time to delve deeper into this fascinating field and harness the power of financial derivatives to achieve your financial goals.