Welcome to our comprehensive guide on understanding and navigating the stock market. Whether you are a seasoned investor or a beginner looking to dip your toes into the world of stocks, this article will provide you with the knowledge and strategies needed to make informed decisions. In section one, "Understanding the Stock Market: A Comprehensive Guide to Investing and Trading," we will delve into the fundamentals of the stock market, explaining key concepts and terminology. In section two, "Navigating the Stock Market: Tips for Buying, Selling, and Dealing with Shares," we will provide practical advice on how to approach buying and selling shares, including tips on timing and market analysis. Finally, in section three, "Exploring the Bull Market and Blue-Chip Stocks: Strategies for Maximizing Profits," we will explore strategies for capitalizing on bull markets and the potential of blue-chip stocks. So, whether you are looking to sell shares, engage in share dealing, or simply want to understand the dynamics of the bull market and blue-chip stocks, this article has got you covered. Let's dive in and unlock the potential of the stock market together.

1. “Understanding the Stock Market: A Comprehensive Guide to Investing and Trading”

Understanding the Stock Market: A Comprehensive Guide to Investing and Trading

The stock market is a dynamic and complex financial ecosystem where individuals and organizations can buy and sell shares of publicly traded companies. It serves as a platform for investors to participate in the growth and success of various businesses, while also providing opportunities for trading and making profits.

Investing in the stock market involves buying shares of a company with the expectation that their value will increase over time. This can be done through different types of investment vehicles, such as mutual funds, exchange-traded funds (ETFs), or individual stocks. Before diving into the stock market, it is crucial to understand the basics of investing and trading to make informed decisions.

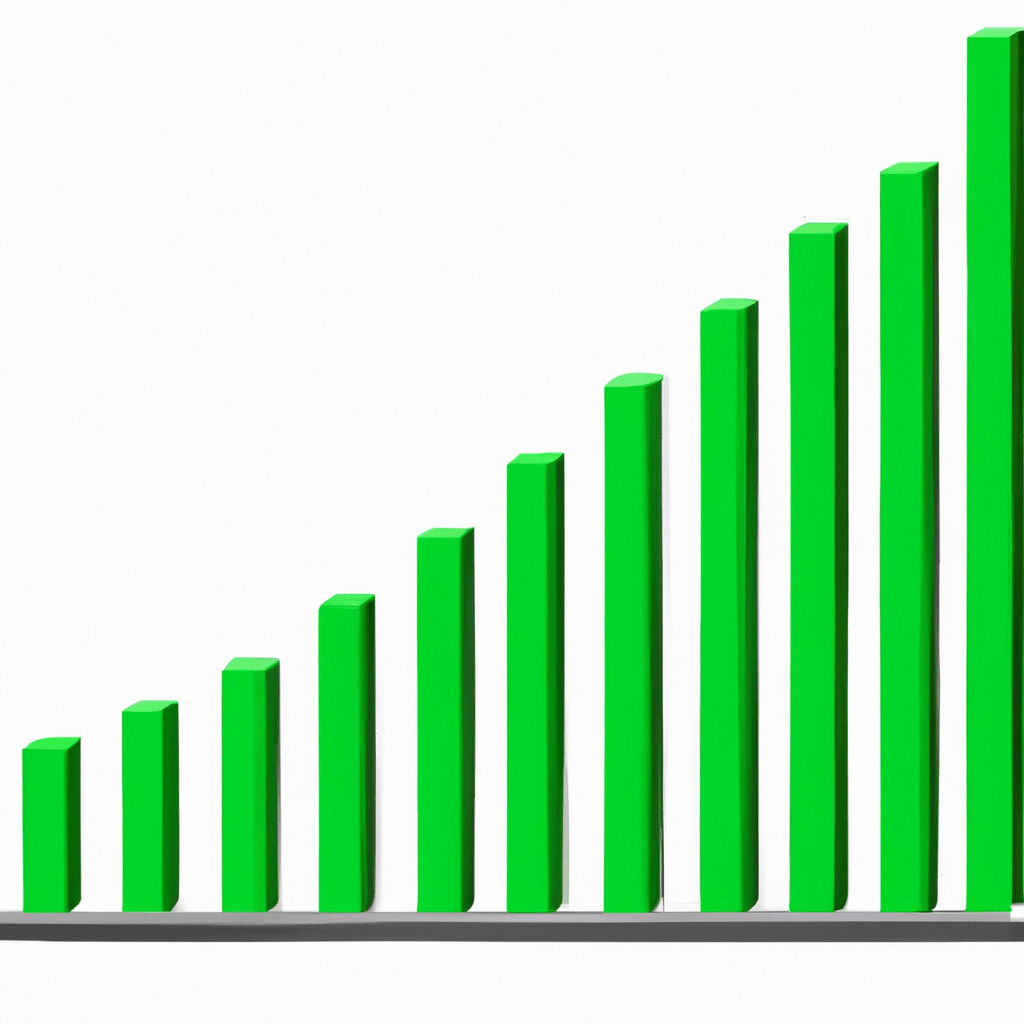

One of the primary reasons people invest in the stock market is the potential for capital appreciation. In a bull market, which is characterized by rising stock prices, investors can benefit from the upward trend and see their investments grow. However, it is important to remember that the stock market is subject to volatility and fluctuations. Therefore, conducting thorough research and analysis before investing is essential to mitigate risks.

When it comes to trading in the stock market, investors can engage in share dealing to capitalize on short-term price movements. Share dealing involves buying and selling shares within a relatively short timeframe, aiming to make a profit from the fluctuations in the market. Traders often use technical analysis tools and indicators to identify potential entry and exit points for their trades.

While trading can be lucrative, it is essential to approach it with caution and understand the risks involved. In addition to technical analysis, traders should stay updated on market news, economic indicators, and company-specific events that may impact stock prices. This information can be crucial in making informed trading decisions and managing risks effectively.

When investing or trading in the stock market, it is also common to come across the term "blue-chip stocks." Blue-chip stocks refer to shares of well-established, financially stable companies with a long track record of success. These companies are often leaders in their industries and tend to provide consistent dividend payments. Blue-chip stocks are considered less volatile and are popular among conservative investors who prioritize stability and income generation.

In conclusion, understanding the stock market is essential for anyone interested in investing or trading. By grasping the basics of investing, such as buying and selling shares, and being aware of concepts like bull markets and blue-chip stocks, individuals can navigate the stock market with confidence. However, it is crucial to conduct thorough research, stay informed, and seek advice from financial professionals to make well-informed decisions and manage risks effectively.

2. “Navigating the Stock Market: Tips for Buying, Selling, and Dealing with Shares”

Navigating the Stock Market: Tips for Buying, Selling, and Dealing with Shares

The stock market can be a complex and ever-changing landscape, but with the right knowledge and strategies, individuals can successfully navigate this financial realm. Whether you are a seasoned investor or a beginner looking to dip your toes into the stock market, here are some valuable tips for buying, selling, and dealing with shares.

1. Educate Yourself: Before diving into the stock market, it is crucial to educate yourself about the basics of investing. Understand the different types of stocks, such as blue-chip stocks, which are shares of well-established and financially stable companies. Familiarize yourself with market trends, terminology, and the overall functioning of the stock market. Make use of reliable resources like financial news websites, books, and online courses to enhance your knowledge.

2. Set Clear Goals: Determine your investment goals and objectives before entering the stock market. Are you looking for long-term growth or short-term gains? Are you willing to take on higher risks for potentially higher returns? Having clear goals will help you make informed decisions and select the appropriate stocks to invest in.

3. Research, Research, Research: Thoroughly research the companies you are interested in before buying their shares. Analyze their financial statements, growth prospects, competitive advantages, and any potential risks. Stay updated with the latest news and developments in the industry to make informed investment decisions.

4. Diversify Your Portfolio: One of the golden rules of investing is to diversify your portfolio. Spreading your investments across different sectors, industries, and asset classes can help mitigate risk. A diversified portfolio can protect you from significant losses if a particular sector or company underperforms.

5. Timing is Key: Timing plays a crucial role in buying and selling shares. Keep an eye on market trends and indicators, such as the bull market, which represents a period of rising stock prices. However, try to avoid making impulsive decisions based solely on short-term market fluctuations. Instead, focus on long-term trends and the fundamentals of the companies you are investing in.

6. Monitor and Review: Regularly monitor your stock portfolio's performance and review your investments. Keep track of company news, industry trends, and any changes that may affect the value of your shares. Stay disciplined and be prepared to make necessary adjustments to your portfolio as per your investment goals.

7. Seek Professional Advice: If you are unsure about navigating the stock market on your own, consider seeking professional advice from financial advisors or brokers. They can provide personalized guidance based on your risk tolerance, financial goals, and investment horizon.

In conclusion, successfully navigating the stock market requires a combination of knowledge, research, and patience. By educating yourself, setting clear goals, diversifying your portfolio, and making informed decisions, you can increase your chances of achieving long-term financial growth and success in the stock market. Remember to stay vigilant, adapt to market conditions, and seek guidance when needed.

3. “Exploring the Bull Market and Blue-Chip Stocks: Strategies for Maximizing Profits”

In the world of stock market investing, understanding the dynamics of a bull market and identifying lucrative opportunities in blue-chip stocks are essential strategies for maximizing profits. A bull market refers to a period of time when stock prices consistently rise, creating an optimistic investor sentiment. During such periods, investors are typically more willing to buy and hold stocks, fueling market growth and providing opportunities for significant gains.

To take advantage of the bull market, it is crucial to stay informed and monitor market trends. Researching and analyzing various blue-chip stocks can help identify companies with strong fundamentals, stable earnings, and a track record of consistent dividend payments. Blue-chip stocks are shares of large, well-established companies that are known for their strong financial performance and market dominance. These stocks are often considered less volatile and safer investments compared to smaller, riskier companies.

One strategy for maximizing profits in a bull market is to invest in blue-chip stocks that have demonstrated resilience and growth potential. These stocks tend to outperform during bullish periods due to their established market position and ability to generate steady returns. By focusing on blue-chip stocks, investors can minimize the risk associated with smaller, less established companies that may be more susceptible to market volatility.

Another approach to maximizing profits in a bull market is to regularly review and rebalance your investment portfolio. As market conditions change, certain stocks may outperform while others may underperform. By selling shares of stocks that have reached their peak value and reallocating funds to potentially undervalued stocks, investors can take advantage of market fluctuations and increase their overall returns.

Engaging in share dealing activities, such as buying and selling stocks, requires a well-defined strategy and disciplined approach. It is important to set realistic goals, establish a risk tolerance, and conduct thorough research before making any investment decisions. Additionally, diversifying your portfolio by investing in a variety of blue-chip stocks across different sectors can help mitigate risk and maximize potential returns.

In conclusion, understanding the dynamics of a bull market and exploring opportunities in blue-chip stocks are effective strategies for maximizing profits in the stock market. By staying informed, researching, and analyzing the market trends, investors can identify promising blue-chip stocks and capitalize on their growth potential. Regularly reviewing and rebalancing the investment portfolio, along with engaging in share dealing activities, can further enhance profitability. Ultimately, a well-informed and disciplined approach is key to achieving success in the ever-changing stock market landscape.

In conclusion, understanding the stock market is crucial for anyone looking to invest and trade in shares. This comprehensive guide has provided valuable insights into the intricacies of the stock market, from the basics of buying and selling shares to navigating the complexities of the bull market and blue-chip stocks. By implementing the tips and strategies discussed in this article, investors can maximize their profits and make informed decisions when it comes to share dealing. It is important to stay updated on market trends and to continuously educate oneself about the stock market to stay ahead in this ever-evolving industry. Whether you are a novice investor or a seasoned trader, the stock market offers endless possibilities for growth and financial success. So, take the plunge, explore the world of stocks, and make the most of the opportunities that the stock market has to offer.