Welcome to our comprehensive guide to understanding the stock market and navigating the world of investing and share dealing. Whether you are a seasoned investor or just starting out, the stock market can be a complex and ever-changing landscape. In this article, we will break down the fundamentals of the stock market and provide valuable insights on how to maximize profits in a booming bull market. Additionally, we will delve into the world of blue-chip stocks, offering an ultimate guide to investing in reliable and high-performing companies. So, if you're ready to dive into the exciting and potentially lucrative world of the stock market, let's begin our journey together.

1. “Understanding the Stock Market: A Comprehensive Guide to Investing and Share Dealing”

Understanding the Stock Market: A Comprehensive Guide to Investing and Share Dealing

The stock market is a dynamic and complex financial system where investors can buy and sell shares of publicly traded companies. It serves as a platform for businesses to raise capital and for individuals to grow their wealth. However, navigating the stock market can be intimidating for beginners. This comprehensive guide aims to demystify the stock market and provide valuable insights into investing and share dealing.

Investing in the stock market involves purchasing shares of companies with the expectation of generating a profit over time. When investors buy shares, they become partial owners of the company and have the potential to benefit from its success. On the other hand, selling shares allows investors to exit their investment and potentially earn a return on their initial investment.

Share dealing refers to the buying and selling of shares in the stock market. It involves understanding market trends, analyzing company performance, and making informed decisions. Successful share dealing requires a combination of research, patience, and risk management.

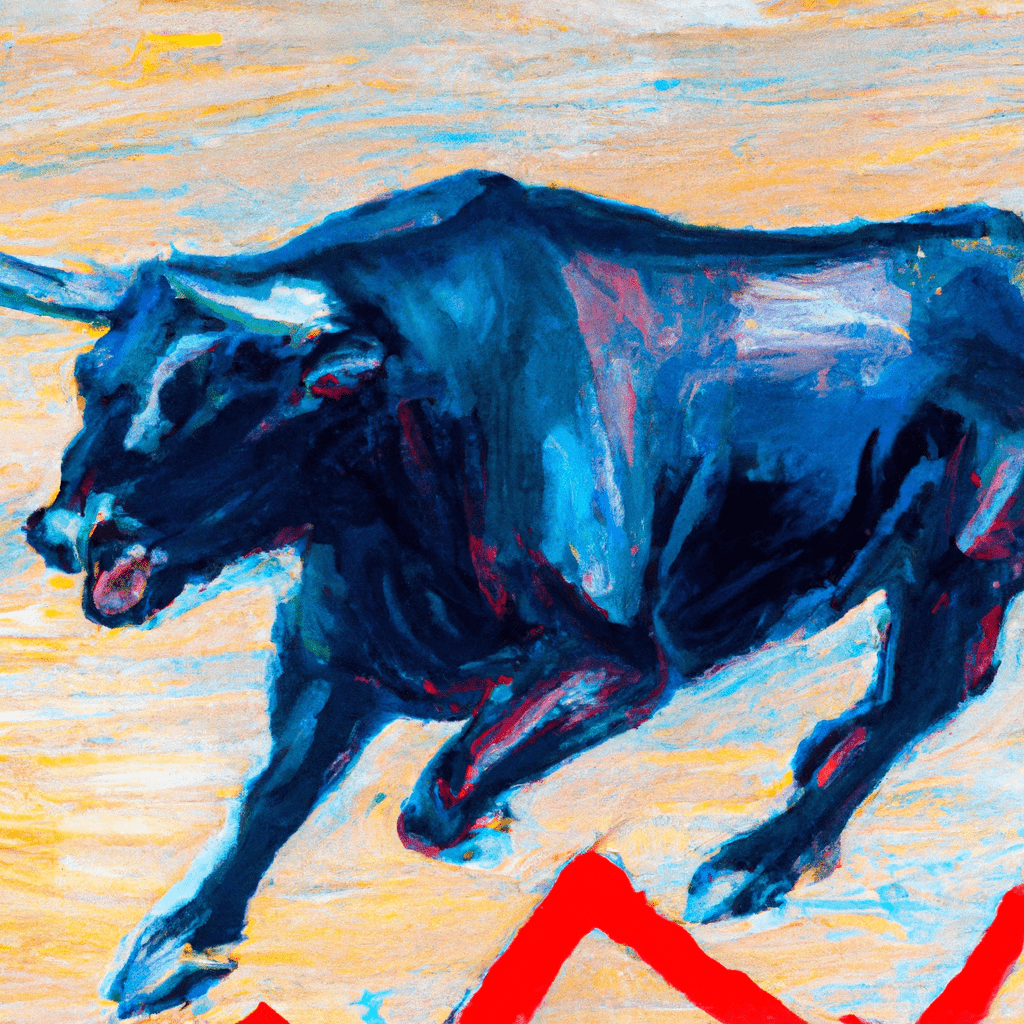

One important concept to grasp when investing in the stock market is the notion of a bull market. A bull market refers to a prolonged period of time when stock prices are rising, and investor confidence is high. During a bull market, many investors are optimistic about the future of the economy and tend to buy more shares. This can lead to significant gains for those who have invested wisely.

Blue-chip stocks are another key aspect of the stock market. These are shares of well-established, financially stable companies with a history of consistent performance. Blue-chip stocks are often considered safe investments due to their track record of weathering economic downturns. They are generally less volatile than smaller, less established companies, making them attractive to risk-averse investors.

In conclusion, understanding the stock market is crucial for anyone looking to invest and engage in share dealing. By familiarizing oneself with the basic concepts of investing, such as buying and selling shares, recognizing bull markets, and considering blue-chip stocks, individuals can make more informed decisions and potentially achieve long-term financial success. Whether you are a seasoned investor or just starting out, the stock market offers a wealth of opportunities for those willing to learn and adapt to its ever-changing nature.

2. “Navigating the Bull Market: Tips for Maximizing Profits in a Booming Stock Market”

Navigating the Bull Market: Tips for Maximizing Profits in a Booming Stock Market

The stock market can be an exciting and profitable place, especially during a bull market. A bull market refers to a period of rising stock prices and investor optimism. During these times, it is crucial for investors to adopt strategies that can help maximize their profits and take advantage of the upward trend.

One key tip for navigating the bull market is to stay informed about the latest market trends and news. Keeping up-to-date with market developments can help investors identify potential investment opportunities and make informed decisions. Additionally, being aware of any market fluctuations or shifts can assist investors in timing their buys and sells effectively.

Selling shares at the right time is another crucial aspect of maximizing profits in a bull market. While it is tempting to hold onto shares for as long as possible, it is important to recognize when a stock has reached its peak and consider selling. Conducting thorough research and utilizing technical analysis tools can help investors identify signs of a potential downturn or when a stock has become overvalued.

Engaging in share dealing, or buying and selling shares, can also be a profitable strategy during a bull market. Investors can take advantage of the upward momentum by actively trading and capitalizing on short-term price fluctuations. However, it is essential to exercise caution and not engage in excessive trading, as it can lead to higher transaction costs and potential losses.

When investing in a bull market, it is also wise to consider blue-chip stocks. Blue-chip stocks are shares of well-established, financially stable companies with a long history of reliable performance. These stocks are often considered safer investments during volatile market conditions. Investing in blue-chip stocks can provide stability and steady returns, making them a valuable addition to a portfolio during a bull market.

In conclusion, the stock market can offer substantial opportunities for investors during a bull market. By staying informed, timing their sells effectively, engaging in share dealing with caution, and considering blue-chip stocks, investors can maximize their profits and navigate the bull market successfully. However, it is essential to remember that investing in the stock market always carries some level of risk, and individuals should consult with a financial advisor before making any investment decisions.

3. “Exploring Blue-Chip Stocks: The Ultimate Guide to Investing in Reliable and High-Performing Companies”

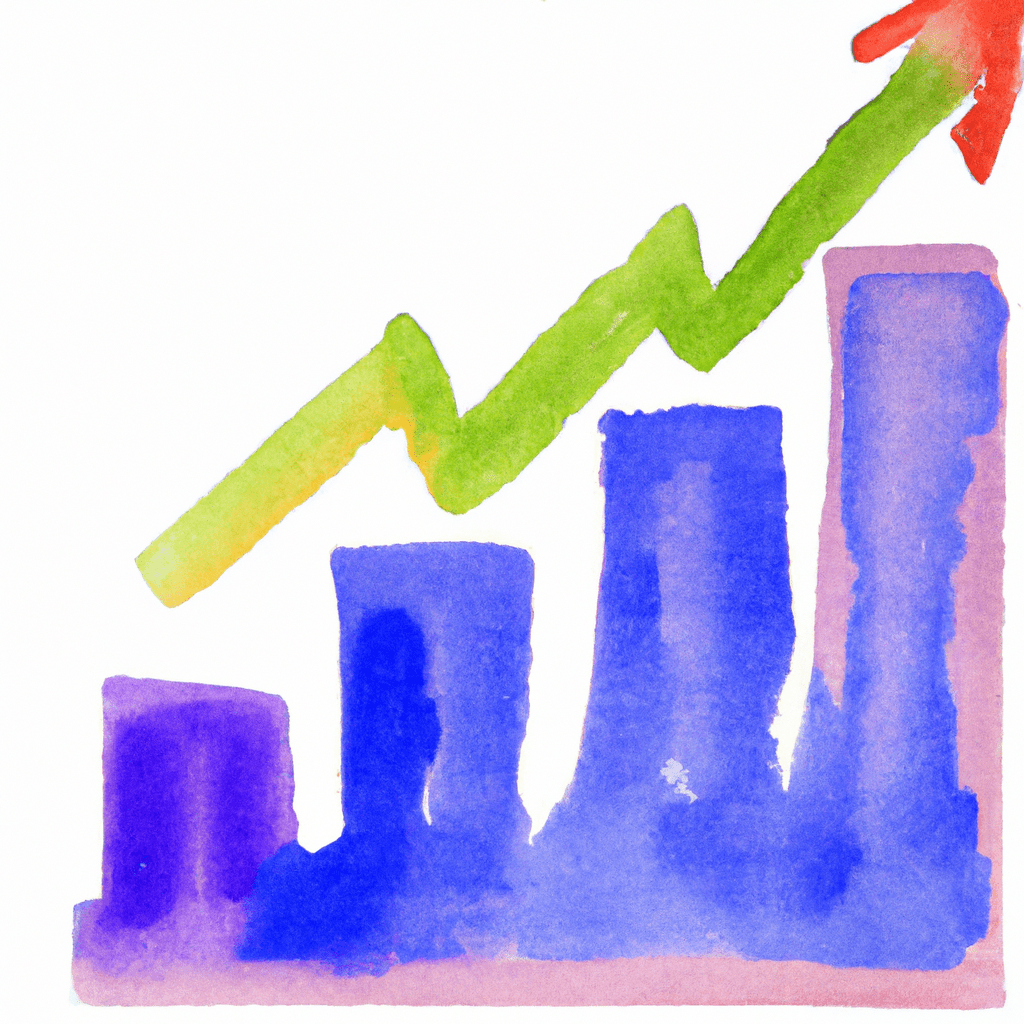

When it comes to investing in the stock market, one strategy that many investors turn to is investing in blue-chip stocks. These stocks are shares of well-established and financially stable companies that have a long-standing history of reliable performance and consistent growth. In this ultimate guide, we will delve into the world of blue-chip stocks and explore why they are considered to be a safe and lucrative investment option.

Blue-chip stocks are typically part of large, well-known companies that have a significant market capitalization and a strong presence in their respective industries. These companies are often leaders in their sectors, with a track record of generating substantial profits year after year. Some examples of blue-chip stocks include household names like Apple, Microsoft, Coca-Cola, and Johnson & Johnson.

One of the key reasons why investors are attracted to blue-chip stocks is their reliability. These companies have proven their ability to weather economic downturns and navigate through challenging market conditions. Their established business models, diverse revenue streams, and solid financial positions make them less susceptible to market volatility compared to smaller or newer companies.

Investing in blue-chip stocks also offers the benefit of liquidity. As these companies have a large number of shares available for trading, it is generally easier to buy and sell shares in comparison to smaller companies. This liquidity provides investors with the flexibility to enter or exit positions quickly, making blue-chip stocks an attractive option for those who value liquidity in the stock market.

Another advantage of investing in blue-chip stocks is the potential for dividend income. Many of these companies have a history of paying regular dividends to their shareholders. Dividends are a portion of a company's profits that are distributed to its shareholders, usually on a quarterly basis. This can be especially appealing to income-oriented investors who are looking for a steady stream of passive income.

It is worth noting that investing in blue-chip stocks does not guarantee success or immunity from market fluctuations. Even the most reliable companies can experience periods of underperformance or face industry-specific challenges. However, blue-chip stocks are generally considered to be a safer bet compared to riskier investments, particularly during volatile times in the market.

In conclusion, blue-chip stocks are a popular choice for investors seeking stability and long-term growth in the stock market. These stocks belong to well-established companies with proven track records of success and are less susceptible to market volatility. With their liquidity, potential for dividend income, and reputation for reliability, blue-chip stocks offer a solid foundation for investors looking to build a profitable portfolio.

In conclusion, understanding the stock market and learning the intricacies of share dealing is crucial for any investor looking to maximize their profits in the bull market. By following the tips provided in this article, individuals can navigate the volatile market and make informed decisions when it comes to buying and selling shares. Additionally, exploring blue-chip stocks can provide a reliable and high-performing investment option for those seeking stability and long-term growth. With a comprehensive understanding of the stock market and the strategies discussed in this article, investors can confidently navigate the ever-changing landscape and make informed decisions to achieve their financial goals.