Welcome to our comprehensive guide to the stock market and investing. Whether you are a beginner looking to understand the basics of share dealing or an experienced investor seeking strategies to navigate the bull market, this article has got you covered. We will also explore blue-chip stocks, the top performers in the stock market. So, if you are ready to learn about the exciting world of stocks and how to make the most of your investments, keep reading.

1. “Understanding the Stock Market: A Beginner’s Guide to Investing and Share Dealing”

Understanding the Stock Market: A Beginner's Guide to Investing and Share Dealing

The stock market is a dynamic and complex system where individuals and institutions buy and sell shares of publicly traded companies. For beginners, navigating the stock market can seem overwhelming, but with a basic understanding of its workings, investing and share dealing can become accessible and potentially lucrative.

Investing in the stock market involves buying shares of companies with the expectation that their value will increase over time. Share dealing, on the other hand, refers to the buying and selling of shares with the intention of making a profit. Both activities require knowledge and research to make informed decisions.

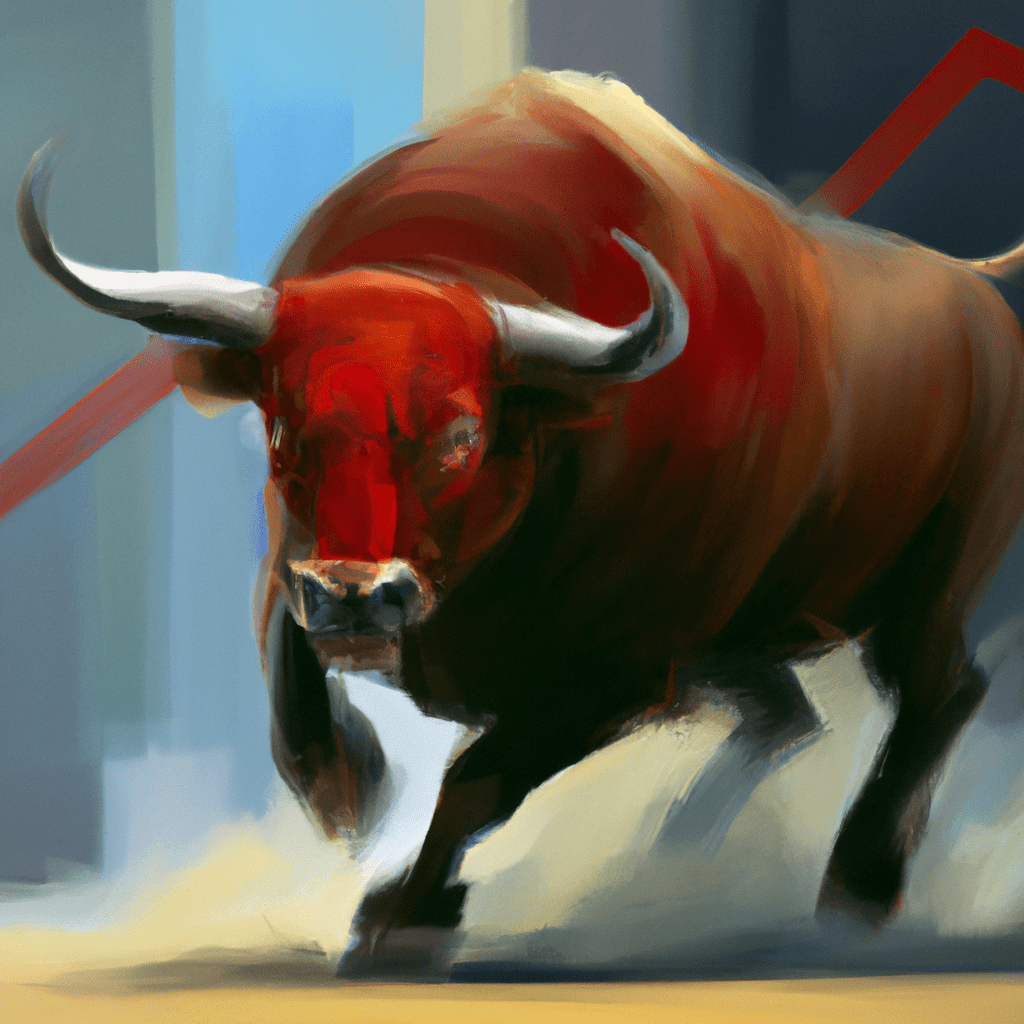

One crucial term to understand in the stock market is the bull market. It refers to a period of time when stock prices are rising, and investor confidence is high. During a bull market, investors generally feel optimistic about the economy, leading to increased buying activity. This can present opportunities for investors to sell shares at a profit.

When considering which stocks to invest in or sell, it is essential to evaluate blue-chip stocks. Blue-chip stocks are shares of well-established, financially stable companies with a history of reliable performance. These companies often have a strong market presence, solid financial statements, and a proven track record of delivering consistent returns to investors. Investing in blue-chip stocks can provide a level of stability and security for beginners entering the stock market.

To begin investing and share dealing, aspiring investors should first educate themselves on the basics of the stock market. This includes understanding key financial concepts, such as earnings per share, price-to-earnings ratio, and market capitalization. It is also crucial to stay updated with financial news, company reports, and market trends to make informed investment decisions.

Furthermore, beginners should consider seeking advice from financial professionals or utilizing online investment platforms that offer educational resources and guidance. These resources can provide valuable insights into the stock market and help individuals develop a well-rounded investment strategy.

In conclusion, the stock market offers opportunities for individuals to grow their wealth through investing and share dealing. By understanding the basics of the stock market, such as the bull market, blue-chip stocks, and the importance of research, beginners can confidently enter this complex world. Remember to stay informed, seek guidance, and make informed decisions when navigating the stock market.

2. “Navigating the Bull Market: Strategies for Profiting in a Rising Stock Market”

Navigating the Bull Market: Strategies for Profiting in a Rising Stock Market

In a bull market, where stock prices are on the rise, investors have the opportunity to make substantial profits. However, it is crucial to approach this market with a well-defined strategy to maximize gains and minimize risks. Here are some key strategies to consider when navigating the bull market.

1. Research and Analysis: Before investing in the stock market, it is essential to conduct thorough research and analysis. This involves studying the overall market conditions, specific sectors, and individual companies. By identifying blue-chip stocks, which are shares of well-established, financially stable companies, investors can position themselves to benefit from the upward market trend.

2. Diversification: Diversifying your investment portfolio is a crucial strategy to mitigate risk in a bull market. By spreading investments across different sectors and industries, investors can reduce the impact of any potential downturn in a particular sector. This diversification can be achieved by investing in different blue-chip stocks, ensuring a balanced exposure to various market segments.

3. Long-Term Investing: While the temptation to sell shares and lock in short-term gains may be strong during a bull market, it is often more beneficial to adopt a long-term investing approach. By holding onto quality blue-chip stocks, investors can capture the full potential of their growth, as these stocks tend to perform well over a longer period. Patience and discipline are key when capitalizing on a rising market.

4. Regular Monitoring and Rebalancing: It is crucial to stay informed and monitor the progress of invested stocks regularly. This enables investors to make timely decisions, such as selling shares that have reached their target price or reallocating funds to other promising opportunities. Regular rebalancing of the portfolio ensures that it aligns with the investor's risk tolerance and investment goals.

5. Seek Professional Advice: Navigating the stock market can be complex, especially during a bull market. Seeking guidance from a professional financial advisor or broker can provide valuable insights and expertise. These professionals can help identify potential investment opportunities, manage risks, and provide guidance on when to buy or sell shares.

In conclusion, navigating a bull market requires a well-thought-out strategy that includes thorough research, diversification, a long-term perspective, regular monitoring, and professional advice. By following these strategies and focusing on blue-chip stocks, investors can position themselves for success and profit from the rising stock market. Remember, investing in the stock market involves risks, and it is always advisable to consult with professionals before making any investment decisions.

3. “Blue-Chip Stocks: Exploring the Top Performers in the Stock Market”

Blue-Chip Stocks: Exploring the Top Performers in the Stock Market

Blue-chip stocks are a popular choice for investors seeking stability and long-term growth in the stock market. These stocks belong to well-established companies with a history of consistent performance, strong financials, and a solid reputation. They are considered the crème de la crème of the stock market, often attracting both individual and institutional investors.

Investing in blue-chip stocks comes with several advantages. Firstly, these stocks tend to be less volatile compared to smaller or riskier companies. This stability is especially appealing during times of market uncertainty or economic downturns. Blue-chip stocks also offer the potential for regular dividend payments, providing investors with a steady income stream. Additionally, these stocks often have a large market capitalization, ensuring liquidity and ease of trading.

To identify the top performers in the stock market, one can look at various factors such as historical returns, financial strength, market dominance, and brand recognition. Some renowned blue-chip stocks include companies like Apple, Microsoft, Amazon, Coca-Cola, and Procter & Gamble. These companies have consistently delivered strong financial results, exhibited resilience during challenging market conditions, and demonstrated an ability to adapt to changing consumer trends.

Investing in blue-chip stocks can be done through various methods, including share dealing platforms or brokerage accounts. Share dealing platforms allow investors to buy and sell shares directly, giving them more control over their investments. It is advisable, however, for investors to conduct thorough research and analysis before making any investment decisions.

One notable blue-chip stock market trend in recent years has been the rise of technology companies. Tech giants like Apple, Microsoft, and Amazon have experienced significant growth, driven by increasing demand for their products and services. These companies have positioned themselves at the forefront of innovation, leading to substantial gains for investors.

In conclusion, blue-chip stocks offer investors an opportunity to participate in the stock market with a lower level of risk and a potentially steady income stream. These stocks belong to well-established companies that have a proven track record of success. By investing in blue-chip stocks, individuals can benefit from the stability and growth potential of these top performers in the stock market.

In conclusion, the stock market offers a world of opportunities for both beginner investors and seasoned traders. With a solid understanding of the stock market and the strategies for navigating a bull market, individuals can profit from their investments and share dealing activities. Blue-chip stocks are particularly attractive, as they have a proven track record of strong performance. However, it is important to remember that investing in the stock market carries risks, and thorough research and analysis are key to making informed decisions. Whether you are looking to buy or sell shares, the stock market can be a lucrative avenue for wealth creation.