Welcome to our comprehensive guide on the stock market, where we will take you on a journey from understanding the basics of investing and share dealing to exploring strategies for maximizing profits in the bull market. Whether you are a beginner looking to dip your toes into the world of stocks or a seasoned investor seeking to expand your knowledge, this article has something for everyone. In the first section, "Understanding the Stock Market: A Beginner's Guide to Investing and Share Dealing," we will demystify the complexities of the stock market and provide you with the essential knowledge needed to start your investment journey. Next, in "Navigating the Bull Market: Strategies for Maximizing Profits in the Stock Market," we will delve into the current market conditions and discuss effective strategies that can help you make the most of this bullish trend. Lastly, in "Exploring Blue-Chip Stocks: Investing in Stable and Reliable Companies for Long-Term Gains," we will shed light on the concept of blue-chip stocks and why they are favored by many investors for their stability and long-term growth potential. So, let's dive in and unlock the secrets of the stock market, enabling you to confidently buy and sell shares, navigate the bull market, and explore the world of blue-chip stocks.

1. “Understanding the Stock Market: A Beginner’s Guide to Investing and Share Dealing”

The stock market can seem like a daunting concept for beginners, but with a basic understanding, anyone can start investing and share dealing. This beginner's guide aims to provide a comprehensive overview of the stock market and equip you with the knowledge to make informed investment decisions.

The stock market is a platform where investors buy and sell shares of publicly traded companies. When you buy a share, you become a partial owner of that company, and your investment can potentially grow as the company's value increases. Conversely, if the company's value decreases, your investment may decline as well.

To start investing in the stock market, you need a brokerage account. Online brokers offer user-friendly platforms where you can buy and sell shares. Opening an account usually requires some personal information and a deposit of funds.

Before investing, it's crucial to research and understand the companies you are interested in. Look for information such as their financial health, management team, products or services, and competitive advantages. This research will help you make informed decisions about which stocks to buy or sell.

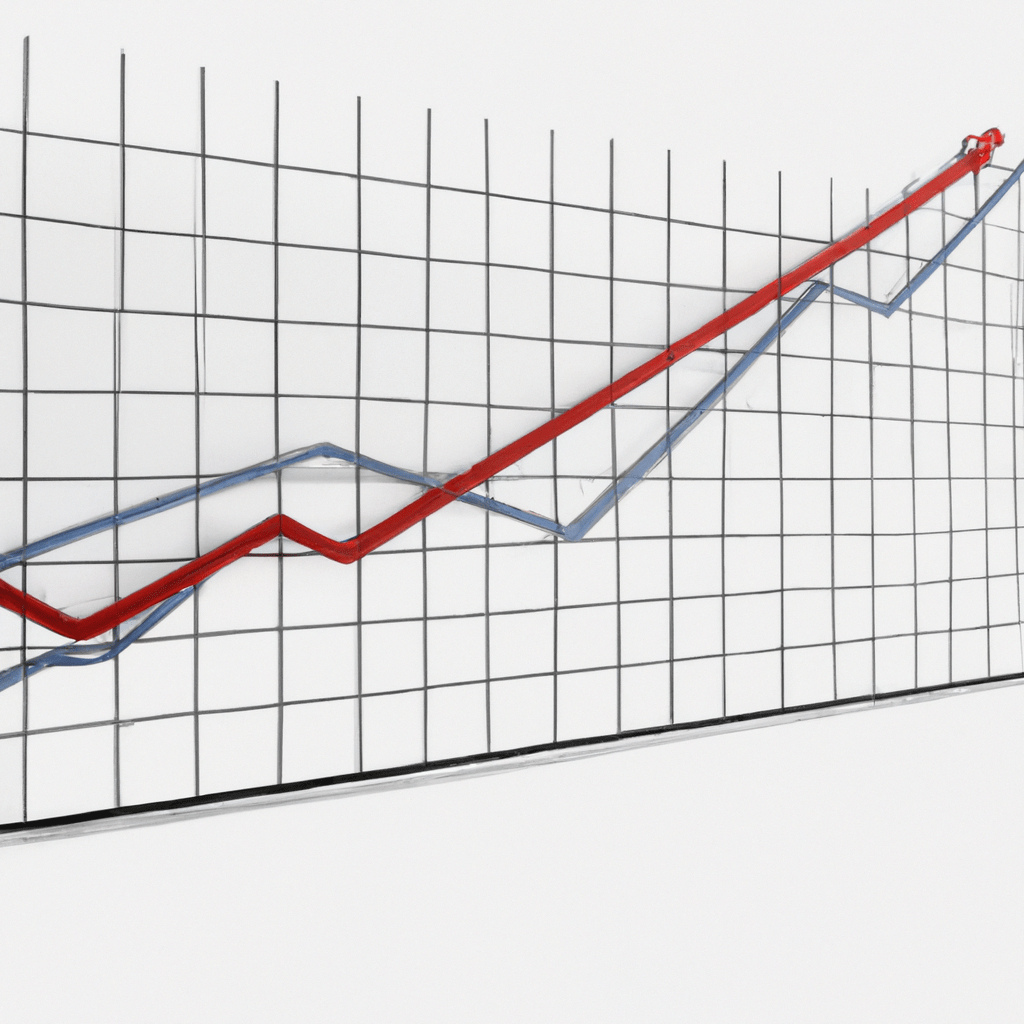

In the stock market, there are two main types of investors: bulls and bears. A bull market refers to a period of rising stock prices, while a bear market indicates falling prices. It's important to note that the stock market experiences periods of both bullish and bearish trends, and it's crucial to consider these market conditions when making investment decisions.

When buying and selling shares, investors often focus on blue-chip stocks. Blue-chip stocks are shares of well-established, financially stable companies with a history of reliable performance. These companies generally have a strong market presence and are considered more reliable investments.

To sell shares, you can place an order with your brokerage account, specifying the number of shares you want to sell and the price you are willing to accept. The brokerage will execute the sell order, and the proceeds will be deposited into your account.

In conclusion, understanding the stock market is essential for beginners looking to invest and engage in share dealing. By grasping the basics, such as how to open a brokerage account, researching companies, and considering market trends, you can make informed investment decisions. Don't forget to focus on blue-chip stocks, and when the time comes, use your brokerage account to sell shares and potentially realize profits.

2. “Navigating the Bull Market: Strategies for Maximizing Profits in the Stock Market”

In the ever-changing landscape of the stock market, investors are often on the lookout for strategies to maximize their profits. One such strategy that can be employed during a bull market is to navigate the market with precision and make informed decisions. A bull market refers to a period of sustained upward movement in the stock market, characterized by rising share prices and investor optimism.

To make the most of a bull market, investors should consider various strategies. Firstly, it is crucial to conduct thorough research and analysis before investing in any stocks. This involves studying the financial performance, market trends, and future prospects of companies. By focusing on blue-chip stocks, which are shares of well-established companies with a history of stable earnings and dividends, investors can mitigate some of the risks associated with stock market volatility.

Another strategy to consider during a bull market is to stay disciplined and avoid succumbing to market euphoria. While it may be tempting to buy more shares as prices rise, it is important to assess the fundamental value of the stocks and not overpay. Additionally, setting clear profit targets and stop-loss levels can help investors lock in profits and limit potential losses.

Furthermore, diversification plays a crucial role in maximizing profits in the stock market. By spreading investments across different sectors and asset classes, investors can reduce their exposure to any one industry or stock. This strategy helps to minimize the impact of any adverse events that may affect a particular company or sector, thus safeguarding the overall portfolio.

Lastly, staying informed and regularly monitoring market trends is vital. By keeping track of economic indicators, industry news, and company updates, investors can make timely and well-informed decisions. This includes being aware of any potential sell signals or signs of an overheated market, which may prompt investors to sell shares and secure profits.

In conclusion, navigating a bull market requires careful planning and execution. By conducting thorough research, focusing on blue-chip stocks, staying disciplined, diversifying investments, and staying informed, investors can maximize their profits and make the most of the favorable market conditions. Remember, the stock market can be unpredictable, so it is essential to approach investing with a long-term perspective and seek professional advice when needed.

3. “Exploring Blue-Chip Stocks: Investing in Stable and Reliable Companies for Long-Term Gains”

When it comes to investing in the stock market, there are various strategies and approaches that investors can utilize. One popular investment strategy is to explore blue-chip stocks, which are known for their stability and reliability in providing long-term gains.

Blue-chip stocks refer to shares of well-established companies that have a history of consistent performance and are considered leaders in their respective industries. These companies often have a strong market presence, solid financials, and a proven track record of weathering market downturns. Investing in blue-chip stocks can be seen as a way to mitigate risk and achieve steady returns over time.

One of the primary advantages of investing in blue-chip stocks is their ability to withstand market fluctuations. During periods of economic uncertainty or volatility, these stocks tend to hold their value better than other investments. This stability can provide investors with a sense of security and peace of mind, especially for those focused on long-term wealth accumulation.

Moreover, blue-chip stocks often pay dividends to their shareholders. Dividends are a portion of a company's profits distributed to its shareholders as a reward for investing in the company. These dividends can provide a steady stream of income for investors, further enhancing the potential for long-term gains.

Investing in blue-chip stocks can also be particularly beneficial during a bull market. A bull market refers to a period of sustained upward movement in stock prices, typically accompanied by investor optimism and positive economic indicators. During these periods, blue-chip stocks tend to outperform other stocks due to their stability and strong market positions. Investors who have invested in blue-chip stocks can take advantage of the market's upward momentum and potentially achieve significant returns.

To invest in blue-chip stocks, individuals can engage in share dealing through various brokerage platforms. Share dealing involves buying and selling shares of publicly traded companies, allowing investors to participate in the stock market. It is essential to conduct thorough research and analysis before investing in blue-chip stocks, as market conditions and company performance can influence their value.

In conclusion, exploring blue-chip stocks is a compelling investment strategy for those seeking stability, reliability, and long-term gains in the stock market. These stocks provide investors with the potential for steady returns, the ability to weather market fluctuations, and the opportunity to benefit from dividends. By investing in blue-chip stocks during a bull market and engaging in share dealing, investors can position themselves for success in their investment journey.

In conclusion, the stock market can be a complex and daunting place for beginners, but with the right understanding and strategies, it can also be a lucrative investment opportunity. This article aimed to provide a beginner's guide to investing and share dealing, offering insights into navigating the bull market and maximizing profits. Additionally, it explored the concept of blue-chip stocks, which can provide stable and reliable long-term gains. Whether you are just starting out or looking to diversify your portfolio, understanding the stock market and its various aspects, such as selling shares and investing in blue-chip stocks, is crucial. With the right knowledge and careful decision-making, investors can confidently navigate the stock market and potentially reap significant rewards.