In today's fast-paced and interconnected global economy, understanding the intricacies of the financial market is essential for investors and traders alike. One key tool that can provide valuable insights into the performance of the market is the financial market index. In this article, we will explore the basics of what a financial market index is and how it works. We will also take a global perspective, delving into the world of stock indexes and their significance in the financial market. Finally, we will unveil the top performers among popular stock indexes and analyze their impact on investments. So, whether you are a seasoned investor or just starting out, join us as we dive into the world of financial market indexes and discover the forces that shape the global market.

1. Exploring the Basics: What is a Financial Market Index and How Does it Work?

A financial market index is a measure that represents the performance of a specific segment or the overall stock market. It is a statistical indicator, usually calculated using a weighted average of the prices of selected stocks. This index helps investors gauge the overall health and direction of the market, making it an essential tool for financial analysis and investment decision-making.

World stock indexes are examples of financial market indexes that cover global markets. They provide a snapshot of the performance of various stock markets around the world. Popular stock indexes include the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite in the United States, FTSE 100 in the United Kingdom, Nikkei 225 in Japan, and DAX in Germany.

An index in trading refers to a group of stocks that are combined to represent a particular market or industry sector. These indices are created to track the performance of specific sectors, such as technology, healthcare, energy, financials, consumer goods, and industrials. By monitoring these sector indices, investors can gain insights into the performance of specific industries and make informed investment decisions.

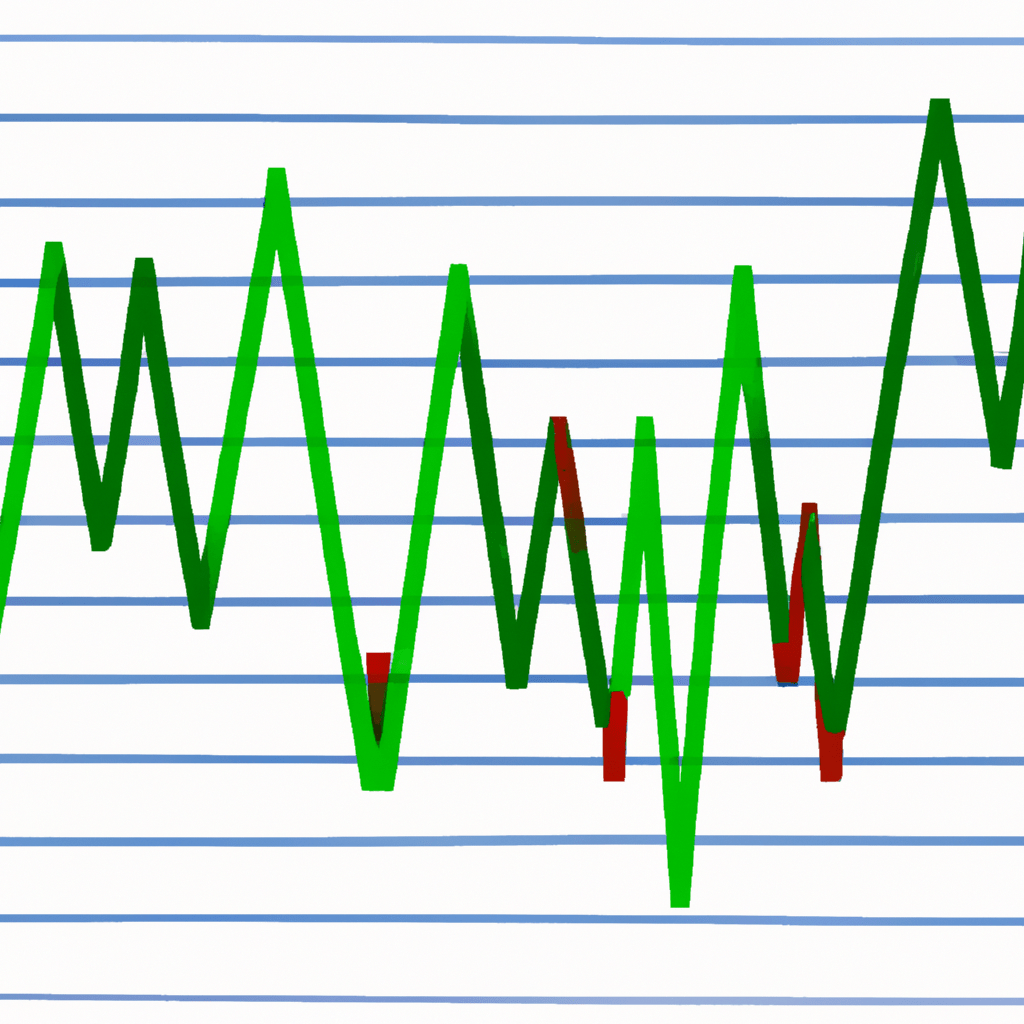

Understanding how a financial market index works involves comprehending its calculation methodology. Typically, an index is calculated by assigning weights to individual stocks based on their market capitalization or other factors, such as price or trading volume. The index value is then calculated using these weighted averages.

Changes in stock prices of the constituent companies impact the value of the index. If the majority of stocks within the index increase in value, the index will rise, indicating a positive market trend. Conversely, if the majority of stocks decline, the index value will decrease, suggesting a bearish sentiment in the market.

Financial market indexes serve as benchmarks against which investment portfolios can be compared. By tracking the performance of an index, investors can evaluate the success of their investments and make adjustments accordingly. Additionally, financial market indexes also serve as underlying assets for index funds, exchange-traded funds (ETFs), and other investment products that aim to replicate the performance of the index.

In conclusion, a financial market index is a crucial tool for investors to assess the overall market performance and make informed investment decisions. World stock indexes, popular stock indexes, and sector indices play a significant role in tracking the performance of global markets, specific industries, and sectors. Understanding how these indexes are calculated and their significance in the investment world empowers investors to navigate the complexities of financial markets.

2. A Global Perspective: Understanding World Stock Indexes and Their Significance in the Financial Market

A Global Perspective: Understanding World Stock Indexes and Their Significance in the Financial Market

In the fast-paced and interconnected world of finance, understanding the global perspective is crucial for investors and traders. One key element of this perspective is comprehending world stock indexes and their significance in the financial market.

Financial Market Indexes, also known as stock indexes or indices, are tools used to measure the performance of a specific group of stocks or the overall stock market in a particular country or region. These indexes provide a snapshot of the market's overall health and help investors gauge the direction and momentum of stock prices.

World stock indexes play a vital role in the financial market by providing valuable insights into global economic trends and market sentiment. They represent the performance of stocks from various sectors and industries, allowing investors to assess the health of different economies around the world and make informed investment decisions.

Popular stock indexes include the Dow Jones Industrial Average (DJIA) in the United States, the FTSE 100 in the United Kingdom, the Nikkei 225 in Japan, and the DAX in Germany. These indexes are composed of a select group of well-established and influential companies that are representative of the overall market.

Understanding the significance of these stock indexes is essential for investors as they provide a benchmark against which individual stocks or portfolios can be compared. By observing the performance of these indexes, investors can assess whether their investments are outperforming or underperforming the broader market.

Furthermore, these indexes also serve as indicators of market sentiment and risk appetite. When stock indexes are rising, it generally signifies positive market sentiment and confidence among investors. On the other hand, a decline in these indexes may indicate a bearish sentiment and a potential downturn in the market.

In addition to country-specific stock indexes, there are also sector-specific indexes that focus on specific industries or sectors within the market. These sector indexes, also known as sector indices, provide insights into the performance of specific sectors such as technology, healthcare, finance, or energy. Understanding these sector indexes allows investors to assess the health and growth potential of specific industries and make sector-specific investment decisions.

The six sectors commonly referred to in market analysis are technology, healthcare, finance, consumer discretionary, industrials, and energy. These sectors represent different segments of the overall economy and provide a diversified view of the market.

In conclusion, a global perspective is crucial in understanding the financial market, and world stock indexes play a vital role in providing valuable insights. These indexes help investors gauge market sentiment, compare the performance of individual stocks or portfolios, and assess the health of different economies. Additionally, sector indexes provide insights into specific industries, allowing investors to make informed sector-specific investment decisions. By staying informed about these popular stock indexes and sector indices, investors can navigate the financial market more effectively and make well-informed investment choices.

3. Unveiling the Top Performers: An In-depth Analysis of Popular Stock Indexes and Their Impact on Investments

When it comes to navigating the complex world of financial markets, understanding stock indexes is crucial for investors. A financial market index is a statistical measure that represents the performance of a specific segment or the entire market. These indexes are often used as benchmarks to track the overall health and performance of a particular market or sector.

One of the key benefits of financial market indexes is their ability to unveil the top performers. By analyzing popular stock indexes, investors can gain valuable insights into the best-performing companies and sectors. This in-depth analysis allows investors to make informed decisions and allocate their investments strategically.

World stock indexes play a significant role in providing a global perspective on market performance. These indexes encompass various countries and regions, giving investors a comprehensive view of the worldwide market trends. By monitoring world stock indexes, investors can identify emerging markets, potential risks, and investment opportunities across the globe.

Popular stock indexes like the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq Composite are widely recognized and closely followed by investors. These indexes represent different segments of the market and provide insights into specific sectors, such as technology, finance, or healthcare. Understanding the impact of these popular stock indexes on investments is crucial for investors looking to diversify their portfolio or focus on specific sectors.

To fully comprehend the significance of stock indexes, it is essential to understand what indices are in trading. An index in trading refers to a statistical measure of change in a securities market. It represents the average performance of a group of securities, such as stocks or bonds, and is used as a benchmark to evaluate investment performance.

In trading, there are six sectors indices that represent different sectors of the economy. These sectors include technology, healthcare, finance, consumer goods, industrial, and utilities. Each sector index comprises companies operating within that specific industry, allowing investors to assess the performance and trends within different sectors of the economy.

In conclusion, financial market indexes are powerful tools for investors to gauge the performance of markets, identify top performers, and make informed investment decisions. World stock indexes provide a global perspective, while popular stock indexes offer insights into specific sectors. Understanding the concept of indices in trading and the six sectors indices further aids in analyzing market trends and sector-specific performances. By leveraging these tools, investors can navigate the financial markets with confidence and potentially optimize their investment returns.

In conclusion, the financial market index is a crucial tool that provides a snapshot of the overall performance of the market. It allows investors to gauge the health and direction of the market, make informed decisions, and manage their risk effectively. World stock indexes play a significant role in the global financial market, providing insight into the performance of various economies and sectors. Additionally, popular stock indexes offer valuable information on the top-performing companies, enabling investors to identify potential investment opportunities. Overall, understanding and utilizing financial market indexes can greatly enhance investment strategies and ultimately lead to financial success.