In today's fast-paced global economy, keeping track of financial markets and understanding their performance is crucial for investors and traders alike. One powerful tool that aids in this endeavor is the financial market index. A comprehensive guide to understanding this essential concept, this article delves into the intricacies of financial market indexes, exploring their significance, key players, and global trends. From popular stock indexes to the six sector indices, we demystify the world of indices in trading, providing you with everything you need to know to navigate the complex world of financial markets. So, whether you are a seasoned investor or just starting your journey in the world of trading, read on to gain valuable insights into the fascinating realm of financial market indexes.

1. “Understanding Financial Market Index: A Comprehensive Guide”

Understanding Financial Market Index: A Comprehensive Guide

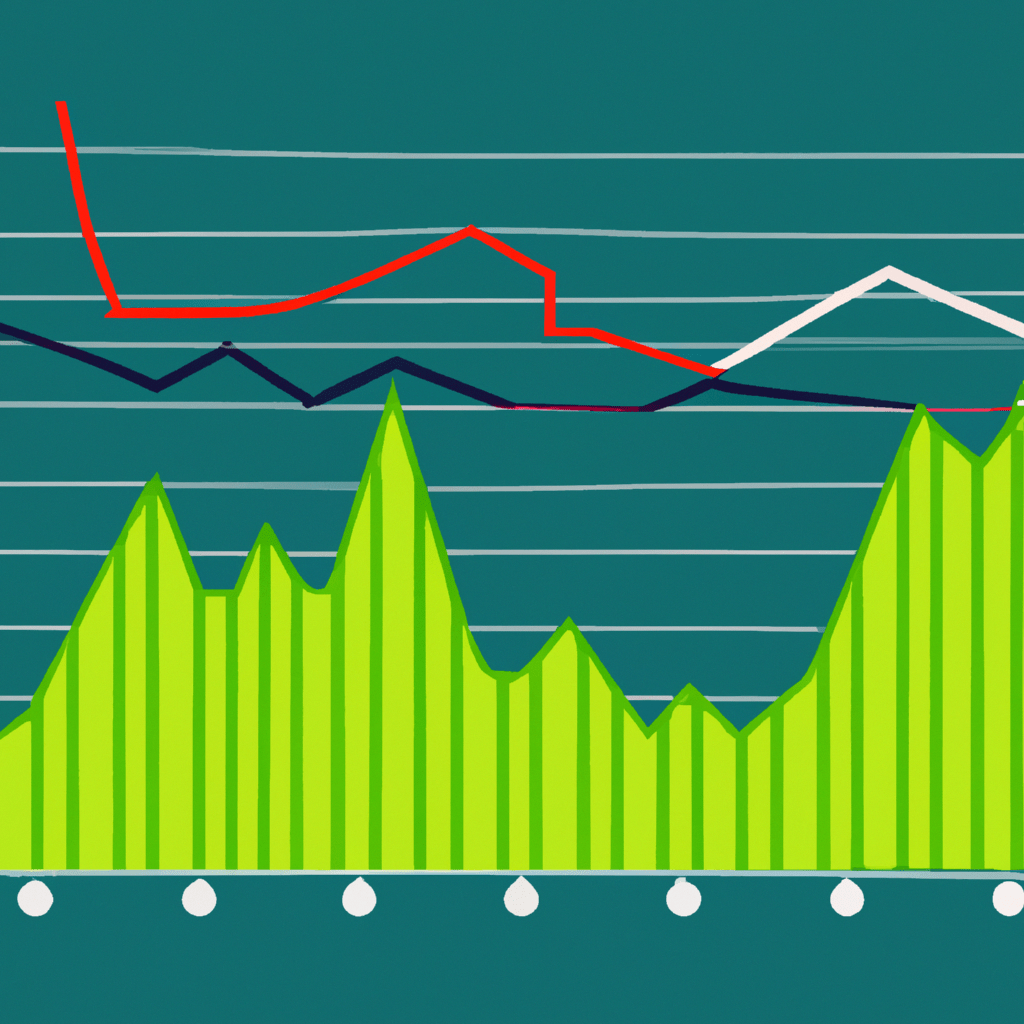

The financial market index is a key tool used in the world of investing and trading. It serves as a benchmark that tracks the performance of a specific group of stocks, providing investors and analysts with vital information about the overall health and direction of the market. In this comprehensive guide, we will explore the concept of financial market indexes, their importance, and the different types of indexes that exist.

Financial Market Index:

A financial market index is a statistical measure that represents the performance of a specific segment of the market. It is typically composed of a basket of stocks that are selected based on certain criteria, such as market capitalization, industry sector, or geographical location. By tracking the movement of these selected stocks, an index provides a snapshot of the market's overall performance.

As the name suggests, world stock indexes encompass a broader range of stocks from various countries and regions. These indexes are designed to give investors a global perspective on the performance of the equity markets. Examples of popular world stock indexes include the MSCI World Index, FTSE All-World Index, and the S&P Global 100 Index.

Popular Stock Indexes:

Within each country, there are specific stock indexes that are widely recognized and followed by investors. These indexes are typically composed of stocks from the largest and most influential companies in the respective country's economy. For example, the Dow Jones Industrial Average (DJIA) in the United States, the FTSE 100 in the United Kingdom, and the Nikkei 225 in Japan are all prominent examples of popular stock indexes.

What is an Indices in Trading?

In the context of trading, an index refers to a representation of a particular market or sector. It allows traders to track the performance of a specific group of stocks without having to trade each individual stock separately. This provides a convenient way for traders to gain exposure to a particular market or sector without the need for extensive research on individual stocks.

What are the Six Sectors Indices?

The six sectors indices are a categorization of stocks based on industry sectors. These sectors include technology, healthcare, financials, consumer goods, industrials, and materials. By tracking the performance of stocks within each sector, investors can gain insights into the relative strength or weakness of specific industries. This information can be invaluable when making investment decisions, as it helps to identify trends and potential opportunities within different sectors of the market.

In conclusion, understanding financial market indexes is crucial for investors and traders alike. It allows them to gauge the overall health of the market, track the performance of specific sectors or countries, and make informed decisions about their investment strategies. By familiarizing themselves with world stock indexes, popular stock indexes, and the concept of indices in trading, investors can navigate the complex world of financial markets with greater confidence and success.

2. “Exploring World Stock Indexes: Key Players and Global Trends”

Financial Market Indexes play a crucial role in the global economy as they provide a snapshot of the overall health and performance of a specific market or sector. These indexes serve as benchmarks for investors to gauge the performance of their investments and make informed decisions.

When it comes to World Stock Indexes, there are several key players that dominate the global financial market. Among the most popular and widely recognized stock indexes are the Dow Jones Industrial Average (DJIA), the S&P 500, and the NASDAQ Composite in the United States. These indexes represent the performance of large-cap stocks and are considered to be indicators of the overall health of the American stock market.

In Europe, the FTSE 100 in the United Kingdom, the DAX in Germany, and the CAC 40 in France are prominent stock indexes. These indexes track the performance of companies listed on their respective national stock exchanges and play a crucial role in reflecting the economic conditions in their respective regions.

Moving towards Asia, the Nikkei 225 in Japan, the Hang Seng Index in Hong Kong, and the Shanghai Composite Index in China are widely followed indexes. These indexes provide insights into the performance of Asian markets and are closely watched by investors around the world.

In addition to these popular stock indexes, there are numerous other regional and sector-specific indexes that cater to different market segments. For example, the MSCI World Index represents global equity markets, while the Russell 2000 Index focuses on small-cap stocks in the United States.

To understand the significance of indexes in trading, it is essential to answer the question: what is an index in trading? In simple terms, an index is a composite measure of a group of stocks that represents a specific market segment, industry, or region. It allows investors to track the overall performance of a particular market without having to analyze individual stocks. This provides a quick and convenient way to assess market trends and identify investment opportunities.

When discussing financial market indexes, it is worth mentioning the concept of sector indices. The six sectors indices refer to the classification of companies into six broad industry groups: financial, technology, healthcare, consumer discretionary, industrial, and energy. These sector indices play a vital role in analyzing market trends and understanding the performance of specific industries. By tracking these sector indices, investors can gain insights into the overall health of different sectors and make informed investment decisions accordingly.

Overall, exploring world stock indexes provides valuable insights into global market trends and the performance of different sectors. Understanding the significance of financial market indexes, the popular stock indexes, and the concept of sector indices enables investors to make informed decisions and navigate the complex world of trading more effectively.

3. “Demystifying Indices in Trading: Everything You Need to Know”

In the world of trading and investing, financial market indices play a crucial role in understanding the overall performance of various sectors and markets. Whether you are a seasoned investor or just starting out, understanding indices is essential to making informed decisions and maximizing your returns. In this article, we will demystify indices in trading by providing you with everything you need to know.

First and foremost, what exactly is a financial market index? Simply put, it is a statistical measure that represents the value of a specific segment of the market. It allows investors to track the performance of a group of stocks, bonds, or other assets, providing a benchmark to evaluate the overall market trends. These indices are calculated using a weighted average of the individual components, typically based on market capitalization.

There are numerous financial market indices around the world, with each country having its own set of popular stock indexes. For instance, the United States has the S&P 500, Dow Jones Industrial Average (DJIA), and NASDAQ Composite, which are widely followed by investors globally. These indexes represent the performance of the largest companies listed on the US stock exchanges, providing a snapshot of the overall market conditions.

But what about sectors? In trading, indices are often categorized into different sectors, which represent specific industries or segments of the economy. The six sectors commonly referred to are:

1. Technology: This sector includes companies involved in the development, manufacturing, and distribution of technology-related products and services.

2. Healthcare: Companies operating in the healthcare sector include pharmaceutical manufacturers, healthcare providers, biotechnology firms, and medical device manufacturers.

3. Financials: Financial sector indices comprise banks, insurance companies, brokerage firms, and other financial institutions.

4. Consumer Discretionary: This sector covers companies that provide non-essential goods and services, such as retail, entertainment, and automotive industries.

5. Industrials: Companies involved in manufacturing, transportation, construction, and engineering fall under the industrials sector.

6. Energy: The energy sector comprises companies engaged in the exploration, production, and distribution of energy resources, including oil, gas, and renewable energy.

Understanding these sectors allows investors to gain insights into the performance of specific industries and make more targeted investment decisions.

In conclusion, financial market indices are vital tools for traders and investors. They provide a comprehensive picture of market trends, allowing individuals to gauge the performance of various sectors and make informed investment decisions. By familiarizing yourself with popular stock indexes and the different sectors they represent, you can stay ahead in the ever-changing world of trading. So, keep an eye on these indices, analyze their movements, and use them to your advantage in navigating the financial markets.

In conclusion, understanding and keeping track of financial market indexes is crucial for investors and traders in today's globalized economy. As discussed in this comprehensive guide, world stock indexes play a significant role in highlighting key players and global trends in the financial markets. By demystifying indices in trading, we have provided readers with the necessary knowledge to navigate this complex field. Whether it is popular stock indexes or the six sectors indices, being well-informed about these indicators can help investors make informed decisions and maximize their returns. Therefore, staying updated with the latest developments in the financial market indexes is imperative for anyone seeking success in the world of trading and investing.