Welcome to our comprehensive guide to understanding the stock market, where we will delve into the intricacies of buying and selling shares. The stock market is a dynamic and ever-changing landscape, and navigating it successfully requires knowledge, strategy, and a keen eye for opportunities. In this article, we will explore the fundamentals of the stock market, provide strategies for maximizing profits in a bull market, and shed light on the benefits of investing in blue-chip stocks. Whether you are a seasoned investor or a novice looking to dip your toes in the world of share dealing, this guide aims to equip you with the knowledge and tools to make informed decisions and bolster your investment portfolio. So, let's dive in and discover the secrets of the stock market.

1. “Understanding the Stock Market: A Comprehensive Guide to Buying and Selling Shares”

The stock market can be a complex and intimidating place for those who are unfamiliar with its inner workings. However, with a comprehensive understanding of how it operates, buying and selling shares can become a lucrative endeavor. This guide aims to demystify the stock market, providing a step-by-step explanation of the process and offering valuable insights for both novice and experienced investors.

To begin, it is essential to grasp the fundamental concept of the stock market. In simple terms, it is a platform where individuals and institutions can buy and sell shares of publicly traded companies. These shares represent ownership in the company and provide investors with the opportunity to participate in its growth and success.

When it comes to buying and selling shares, there are several key players involved. Brokerage firms act as intermediaries, facilitating transactions between buyers and sellers. Investors can choose between traditional brokerages or online platforms, depending on their preferences and needs.

Before diving into the stock market, it is crucial to conduct thorough research. Understanding the company's financial health, industry trends, and market conditions will enable investors to make informed decisions. This due diligence can help identify potential investment opportunities and mitigate risks.

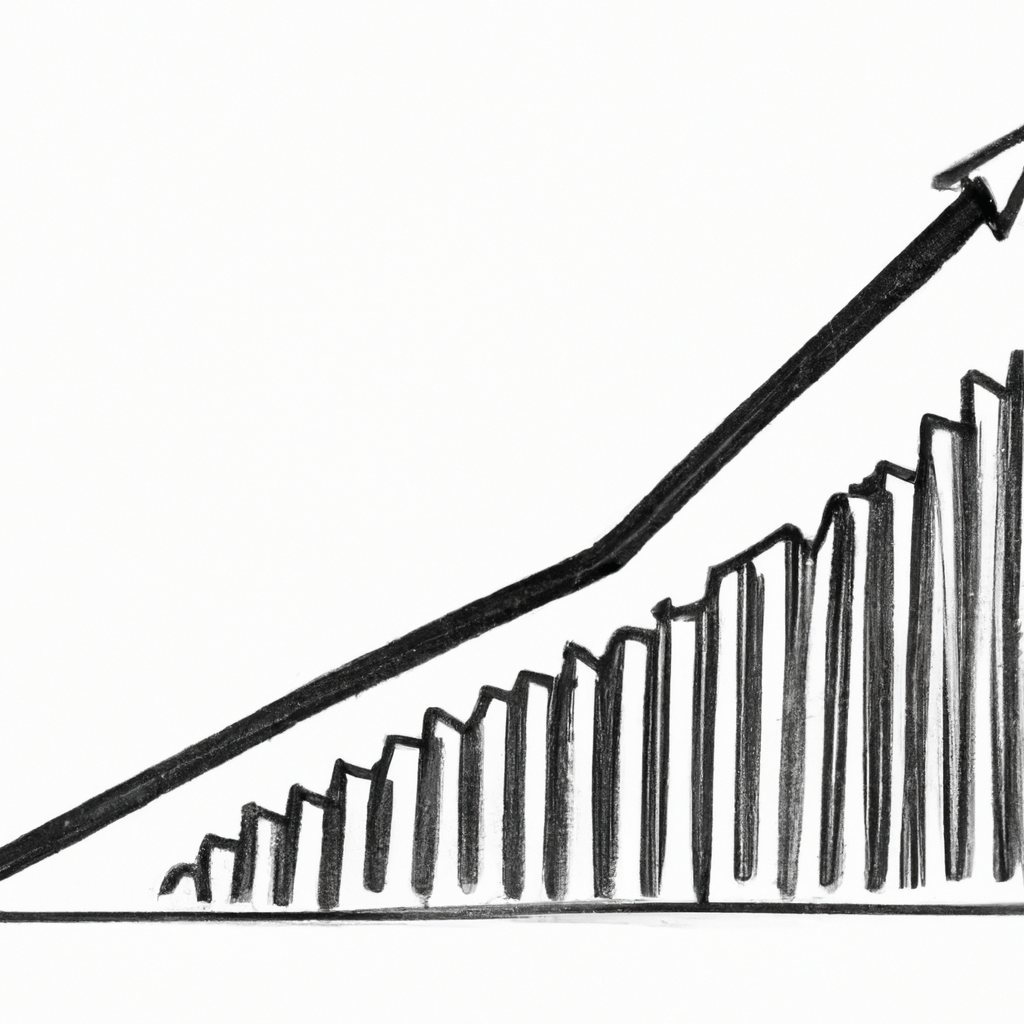

When it comes to selling shares, timing is often critical. Investors aim to sell their shares at a profit, taking advantage of the bull market when stock prices are generally rising. However, predicting market fluctuations is challenging, and it is wise to stay updated with market news and trends to make informed decisions.

While the stock market offers a vast array of investment options, one popular strategy is investing in blue-chip stocks. These stocks belong to well-established, financially stable companies with a history of reliable performance. Blue-chip stocks are considered relatively low-risk investments, making them attractive to conservative investors seeking stability.

In conclusion, understanding the stock market is crucial for anyone looking to buy and sell shares. By conducting in-depth research, staying informed about market trends, and considering investment strategies such as blue-chip stocks, investors can navigate the stock market with confidence. While there are risks involved, a comprehensive understanding of the stock market can lead to rewarding investment opportunities. So, whether you are a seasoned investor or just starting, the stock market holds immense potential for growth and financial success.

2. “Navigating the Bull Market: Strategies for Maximizing Profits in an Optimistic Stock Market”

Navigating the Bull Market: Strategies for Maximizing Profits in an Optimistic Stock Market

In an optimistic stock market, commonly referred to as a bull market, investors are presented with numerous opportunities to maximize their profits. This article will delve into some effective strategies that can help individuals make the most of the current bullish trend.

One strategy that investors can employ during a bull market is to capitalize on the momentum of the market by buying and holding blue-chip stocks. Blue-chip stocks are shares of well-established companies with a history of stable earnings and a strong market presence. These stocks are considered relatively safe investments, as they tend to withstand market volatility better than smaller companies. By investing in blue-chip stocks, investors can take advantage of the market's upward momentum and potentially reap substantial profits.

Another approach to consider in a bull market is to actively monitor market trends and make strategic decisions to sell shares at opportune times. Timing the market can be challenging, but by staying informed about economic indicators, company performance, and industry trends, investors can make informed decisions about when to sell their shares. This strategy allows investors to lock in profits when the market is at its peak and avoid potential losses when the market starts to decline.

Furthermore, engaging in share dealing can provide investors with additional opportunities to maximize profits in a bull market. Share dealing involves buying and selling shares frequently to take advantage of short-term market fluctuations. This strategy requires a keen understanding of market dynamics and the ability to quickly identify potential opportunities. By actively participating in share dealing, investors can capitalize on the volatility of a bull market and generate profits from both rising and falling stock prices.

It is important to note that while a bull market can present favorable conditions for maximizing profits, it is essential to exercise caution and manage risk effectively. Investors should diversify their portfolio to mitigate potential losses and avoid putting all their eggs in one basket. Additionally, staying disciplined and sticking to a well-defined investment strategy can help investors navigate the market's ups and downs more successfully.

In conclusion, the strategies discussed above can assist investors in maximizing their profits during a bull market. By investing in blue-chip stocks, timing their sell decisions strategically, and actively participating in share dealing, individuals can take advantage of the market's optimism and potentially achieve significant gains. However, it is crucial to approach the stock market with a cautious mindset, diversify investments, and adhere to a disciplined investment strategy to mitigate risks and ensure long-term success.

3. “Exploring Blue-Chip Stocks: How These Reliable Investments Can Bolster Your Portfolio”

When it comes to investing in the stock market, one strategy that investors often consider is adding blue-chip stocks to their portfolio. Blue-chip stocks are shares of well-established companies with a long history of stable earnings and a strong market presence. These stocks are known for their reliability and are often considered a safe investment option for long-term investors.

One of the key benefits of investing in blue-chip stocks is their ability to bolster your portfolio. These stocks are typically issued by companies that have a proven track record of success, leading to a higher level of confidence among investors. This confidence translates into a lower level of risk compared to investing in smaller or riskier companies.

Blue-chip stocks are often associated with companies that have a large market capitalization, meaning that they have a high market value. This makes them highly liquid, meaning that it is relatively easy to buy or sell shares of these stocks on the market. Liquidity is an important factor for investors as it allows for easy entry and exit from a position, providing flexibility and minimizing transaction costs.

Another advantage of blue-chip stocks is their ability to perform well even during volatile market conditions. In a bull market, where stock prices are rising and investor confidence is high, blue-chip stocks tend to benefit from increased demand. Their strong market presence and stable earnings make them attractive to investors looking for reliable returns.

Investing in blue-chip stocks also provides investors with the opportunity to earn dividends. Many of these companies have a history of paying regular dividends to their shareholders, providing a steady income stream in addition to potential capital gains. This can be particularly appealing to income-focused investors who are looking for reliable sources of cash flow.

In conclusion, exploring blue-chip stocks can be a valuable addition to any investment portfolio. These reliable investments offer stability, liquidity, and the potential for both capital gains and dividend income. By diversifying your portfolio with blue-chip stocks, you can mitigate risk and position yourself for long-term success in the stock market.

In conclusion, understanding the stock market and its various components is crucial for anyone looking to buy and sell shares. As discussed in this article, navigating the bull market requires strategic thinking and a focus on maximizing profits. Additionally, exploring blue-chip stocks can provide a reliable foundation for any investment portfolio. Whether you are a seasoned investor or just starting out, staying informed and educated about the stock market, share dealing, and the potential of blue-chip stocks is key to success. By implementing the strategies and insights shared in this comprehensive guide, individuals can confidently navigate the stock market and make informed decisions that can lead to financial growth and stability.